Wells Fargo Reflect Visa Card Apply: Benefits, Fees and App!

Anúncios

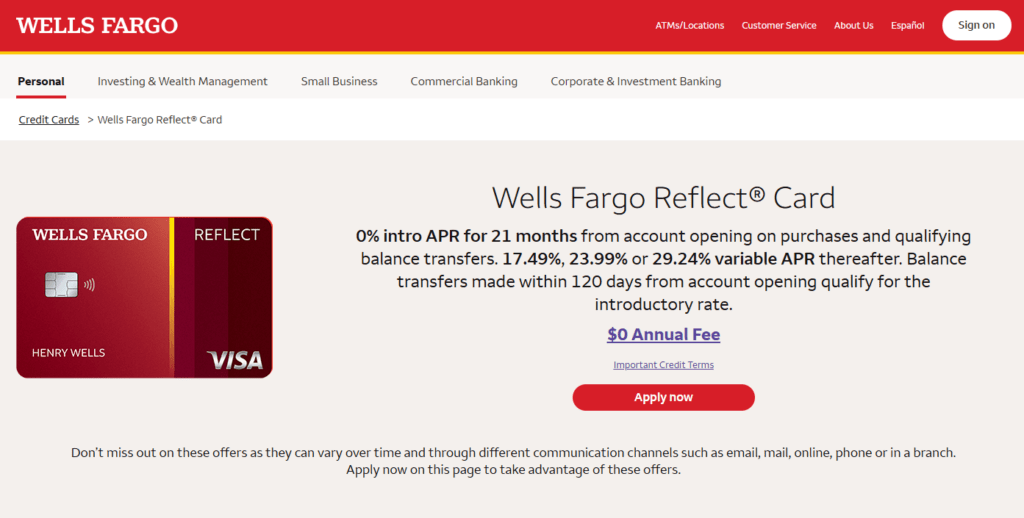

Discover how to apply for the Wells Fargo Reflect Visa Card, its benefits, fees, and for managing your finances with a 0% introductory APR.

Selecting the right credit card is crucial for effective financial management. The Wells Fargo Reflect Visa Card offers a compelling option for those seeking to minimize interest on purchases and balance transfers. With an extended 0% introductory APR period and no annual fee, it stands out as a practical choice for individuals aiming to manage their expenses efficiently.

This guide will walk you through the application process, highlight the card’s features, and help you determine if it aligns with your financial objectives.

How to Apply for the Wells Fargo Reflect Visa Card

Applying for the Wells Fargo Reflect Visa Card is a straightforward process designed to get you started on your financial journey promptly.

Steps to Apply:

- Visit the Wells Fargo Website: Navigate to the Wells Fargo Reflect Visa Card page.

- Click “Apply Now”: Select the “Apply Now” button to initiate the application process.

- Provide Personal Information: Enter your full name, Social Security Number (SSN), date of birth, and residential address.

- Submit Financial Details: Include your employment status, annual income, and housing expenses to assess your creditworthiness.

- Review Terms and Conditions: Carefully read the card’s terms and conditions to understand the rates, fees, and other important information.

- Submit Your Application: After ensuring all information is accurate, submit your application for review.

Upon submission, Wells Fargo will evaluate your application and typically provide a decision within minutes. If approved, you’ll receive your card by mail within 7 to 10 business days.

Why Choose the Wells Fargo Reflect Visa Card

The Wells Fargo Reflect Visa Card offers several features that make it an attractive option for individuals looking to manage their finances effectively.

Key Benefits:

- Extended 0% Introductory APR: Enjoy a 0% introductory APR for 21 months from account opening on purchases and qualifying balance transfers. After the introductory period, a variable APR of 17.49%, 23.99%, or 29.24% applies, based on your creditworthiness. Balance transfers made within 120 days from account opening qualify for the introductory rate.

- No Annual Fee: Benefit from the card’s features without the burden of an annual fee, allowing you to save more.

- Cellular Telephone Protection: Receive up to $600 in protection against damage or theft of your cell phone when you pay your monthly cellular telephone bill with your Wells Fargo Reflect Visa Card. A $25 deductible applies.

- Zero Liability Protection: Rest assured that you won’t be held responsible for unauthorized transactions, provided they’re reported promptly.

- My Wells Fargo Deals: Access personalized deals from a variety of merchants, allowing you to earn cash back as a statement credit when you shop, dine, or enjoy experiences using your eligible Wells Fargo credit card.

These features collectively make the Wells Fargo Reflect Visa Card a valuable tool for managing expenses and protecting your purchases.

Requirements to Apply for the Wells Fargo Reflect Visa Card

Before applying, ensure you meet the basic eligibility criteria for the Wells Fargo Reflect Visa Card.

Eligibility Criteria:

- Residency: Must be a U.S. resident with a valid Social Security Number.

- Age: Applicants must be at least 18 years old (19 in Alabama and Nebraska, 21 in Puerto Rico).

- Credit Standing: A good to excellent credit score is typically recommended for approval.

- Income: Sufficient income to support credit obligations.

Meeting these requirements will facilitate a smooth application process and increase the likelihood of approval.

Discounts and Rewards Program

While the Wells Fargo Reflect Visa Card primarily focuses on offering a lengthy 0% introductory APR period, it also provides opportunities to earn rewards through the My Wells Fargo Deals program.

My Wells Fargo Deals:

- Personalized Offers: Access tailored deals from a variety of merchants, including retailers, restaurants, and service providers.

- Cash Back Earnings: Earn cash back as a statement credit when you activate an offer and make qualifying purchases with your Wells Fargo Reflect Visa Card.

- Easy Redemption: Cash back earned through My Wells Fargo Deals is automatically applied as a statement credit, simplifying the redemption process.

This program enhances the card’s value by providing additional savings on everyday purchases.

Advantages and Disadvantages

Understanding the pros and cons of the Wells Fargo Reflect Visa Card will help you determine if it aligns with your financial needs.

Advantages:

- Lengthy 0% Introductory APR: The 21-month 0% APR period on purchases and qualifying balance transfers is among the longest available, providing ample time to pay down balances without accruing interest.

- No Annual Fee: Enjoy the card’s benefits without the cost of an annual fee.

- Cell Phone Protection: Up to $600 in coverage against damage or theft adds value for those who pay their cell phone bill with the card.

- Zero Liability Protection: Safeguards you against unauthorized transactions, enhancing security.

Disadvantages:

- No Ongoing Rewards Program: Unlike some other cards, the Wells Fargo Reflect Visa Card doesn’t offer a traditional rewards program for everyday spending.

- Balance Transfer Fee: A balance transfer fee of 5% (minimum $5) applies to each balance transfer, which could add up depending on the amount transferred.

- High Variable APR After Introductory Period: Once the introductory period ends, the variable APR can be as high as 29.24%, which may be costly if you carry a balance.

By weighing these factors, you can assess whether the Wells Fargo Reflect Visa Card meets your financial objectives.

What Are the Fees on the Wells Fargo Reflect Visa Card?

Understanding the fees associated with the Wells Fargo Reflect Visa Card is essential for effective financial management.

Fee Breakdown:

- Annual Fee: $0.

- Balance Transfer Fee: 5% of the amount of each balance transfer, with a minimum of $5.

- Cash Advance Fee: Either $10 or 5% of the amount of each advance, whichever is greater.

- Foreign Transaction Fee: 3% of each transaction in U.S. dollars.

- Late Payment Fee: Up to $40.

- Returned Payment Fee: Up to $40.

By being aware of these fees, you can make informed decisions and avoid unnecessary charges.

Contacting Wells Fargo for Assistance

Wells Fargo offers multiple channels to assist you with your Wells Fargo Reflect Visa Card.

Contact Options:

- Phone Support: Call the number on the back of your card or visit the Wells Fargo Contact Us page for assistance.

- Online Banking: Sign in to [Wells Fargo