Resolution Explained: DPI vs. Pixels

Resolution dpi vs pixels? Learn the key differences, how they affect image quality. And which one matters most. Understanding Pixels: The Building Blocks of Digital Images Pixels are the fundamental…

Have you ever tried to switch from one service to another, only to realize that years of your data, contacts, photos, and important information are locked inside the old platform…

TechnologyWhat is a PDF? Learn everything in this complete guide to opening, filling, and signing PDFs easily and securely. Understanding PDF Technology: More Than Just a File Format PDF (Portable…

TipsLearn how scan to google drive on iPhone, Android. And desktop with clear steps, OCR, naming, security, and sharing. What is how to scan to google drive and why it…

Resolution dpi vs pixels? Learn the key differences, how they affect image quality. And which one matters most. Understanding Pixels: The Building Blocks of Digital Images Pixels are the fundamental…

Understand in simple terms how it works, why it matters And the easiest way to protect your files. Explaining Cloud Backup Think of cloud backup like having a safety deposit…

What is a ZIP file? Learn how it works, how to open it on any device And tips to manage compressed files easily Understanding ZIP Files: The Digital Storage Revolution…

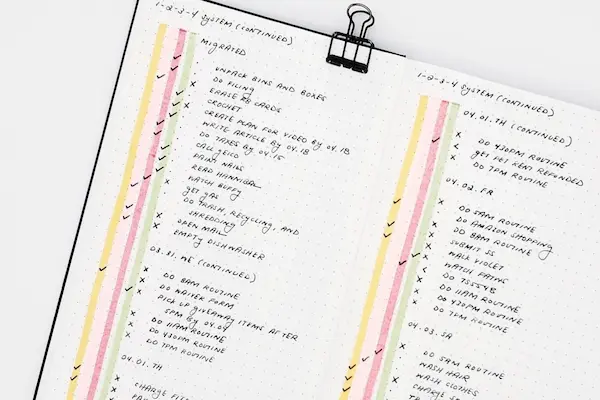

Keeping a simple journal is about making a habit of writing down your thoughts, feelings, or daily experiences without overcomplicating it. The key is to choose a type of journal…

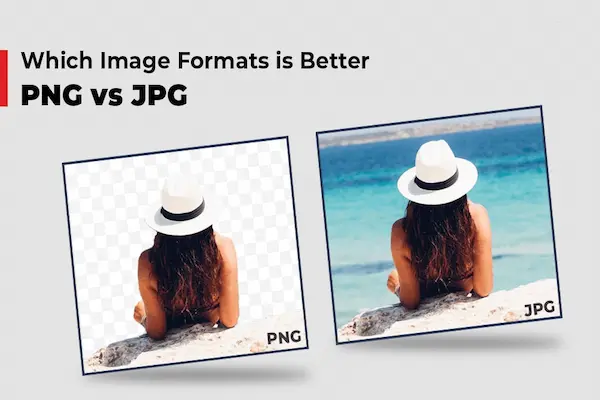

PNG vs. JPG: Discover the key differences, best uses, and how to choose the right image format for your needs. Understanding Image Compression: The Foundation of Format Differences The fundamental…

What is a PDF? Learn everything in this complete guide to opening, filling, and signing PDFs easily and securely. Understanding PDF Technology: More Than Just a File Format PDF (Portable…

Have you ever tried to switch from one service to another, only to realize that years of your data, contacts, photos, and important information are locked inside the old platform…

Picture this: you’re working on an important project when your computer suddenly crashes, the screen goes black, and nothing you try brings it back to life. Or imagine coming home…

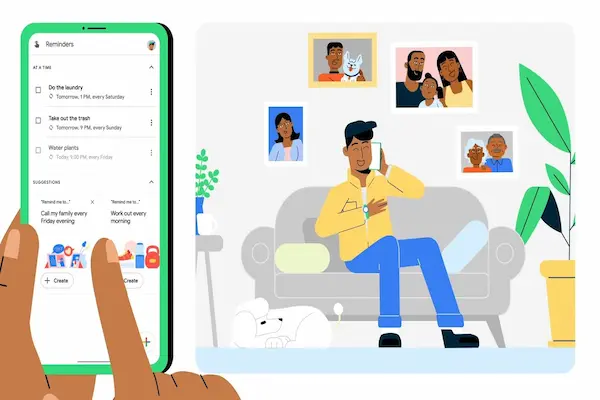

Imagine this: you’re driving to work when you suddenly remember you need to call your doctor to schedule an appointment, but you can’t safely grab your phone to write it…

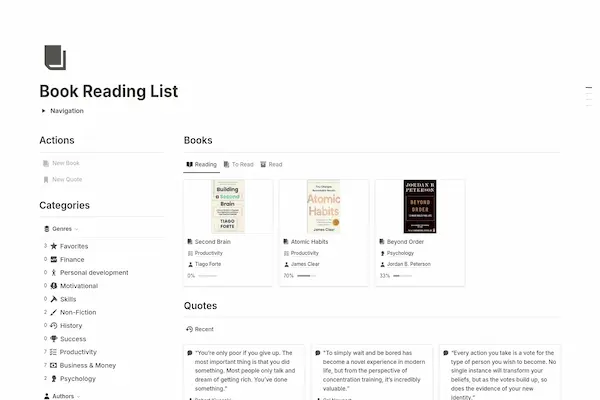

You know that feeling when someone recommends an amazing book, and you think “I should definitely read that” – but three months later, you can’t even remember the title? Or…

Aproveite o melhor da tecnologia com dicas e análises de aplicativos inovadores que podem otimizar seu dia a dia.

Nenhuma seção configurada. Configure os títulos e descrições em Aparência → Personalizar → Configurações do Tema → [Módulo] Notes