Citi Strata Premier Card Apply: Benefits and Costs!

Discover how to apply for the Citi Strata Premier Card, its benefits, fees, and determine if it’s the right choice for your financial needs.

Anúncios

Choosing the right credit card can significantly enhance your financial strategy, especially if it offers rewards for everyday spending. The Citi Strata Premier Card is designed for individuals who want to maximize their rewards on routine purchases.

With unique features like generous bonus categories and no foreign transaction fees, it stands out in the crowded credit card market.But how do you apply, and is it worth it? Let’s delve into the details to help you make an informed decision.

How to Apply for the Citi Strata Premier Card

Applying for the Citi Strata Premier Card is a straightforward process that can be completed online, ensuring convenience and efficiency. Here’s a step-by-step guide to assist you:

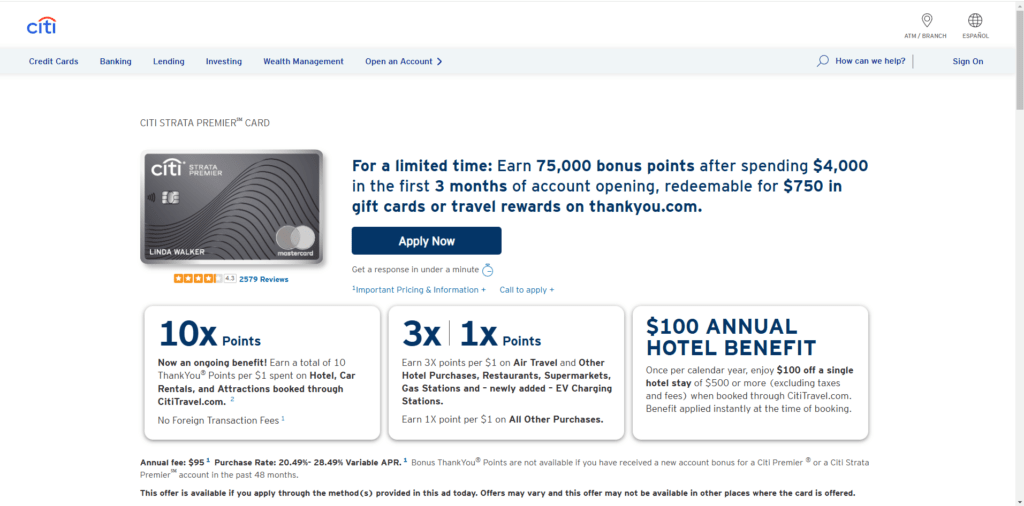

- Visit the Official Citi Website: Navigate to the Citi Strata Premier Card page.

- Initiate the Application: Click on the “Apply Now” button to begin the application process.

- Provide Personal Information: Enter your full name, date of birth, Social Security number, and contact details.

- Submit Financial Details: Include information about your employment status, annual income, and housing expenses.

- Agree to Terms and Conditions: Review and consent to the terms, which include a credit assessment.

- Review and Submit: Double-check all entered information for accuracy and submit your application.

After submission, Citi will review your application and notify you of the outcome, typically within a few business days. If approved, your new card will be mailed to you promptly.

Why Choose the Citi Strata Premier Card

The Citi Strata Premier Card offers a range of benefits tailored to individuals looking to maximize rewards on everyday spending. Here’s an overview of what makes this card appealing:

- Generous Bonus Categories: Earn 10 points per $1 spent on hotels, car rentals, and attractions booked through CitiTravel.com. Earn 3 points per $1 spent on air travel and other hotel purchases, at restaurants, supermarkets, gas and EV charging stations.

- No Foreign Transaction Fees: Enjoy international purchases without additional charges.

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com.

- Flexible Redemption Options: Redeem points for travel, gift cards, or transfer to airline and hotel partners.

These features collectively provide a robust package for cardholders seeking to maximize rewards on everyday purchases.

Requirements to Apply for the Citi Strata Premier Card

Before applying, it’s essential to ensure you meet the eligibility criteria for the Citi Strata Premier Card. The primary requirements include:

- Age: Must be at least 18 years old.

- Social Security Number: A valid Social Security number is required.

- U.S. Residency: Must have a U.S. address.

- Credit Standing: A good to excellent credit score (typically 670 or higher) is recommended for approval.

Meeting these criteria increases the likelihood of a successful application and access to the card’s benefits.

Discounts and Rewards Program

The Citi Strata Premier Card offers a flexible rewards program designed to maximize your points earnings based on your spending habits. Key aspects of the program include:

- 10 Points per $1: Earn 10 points per $1 spent on hotels, car rentals, and attractions booked through CitiTravel.com.

- 3 Points per $1: Earn 3 points per $1 spent on air travel and other hotel purchases, at restaurants, supermarkets, gas and EV charging stations.

- 1 Point per $1: Earn 1 point per $1 spent on all other purchases.

This structure allows you to tailor your rewards to align with your spending patterns, maximizing the value you receive from everyday purchases.

Advantages and Disadvantages

Understanding the pros and cons of the Citi Strata Premier Card will help you assess its suitability for your financial needs.

Advantages:

- Generous Bonus Categories: High earning rates on travel, dining, and everyday purchases.

- No Foreign Transaction Fees: Ideal for international travelers.

- $100 Annual Hotel Benefit: Savings on hotel stays booked through CitiTravel.com.

Disadvantages:

- Annual Fee: A $95 annual fee applies.

- Spending Requirements: The $100 hotel benefit requires a minimum spend of $500 on a single stay.

Weighing these factors will help you determine if the Citi Strata Premier Card aligns with your financial goals and lifestyle.

What Are the Fees on the Citi Strata Premier Card?

Being aware of the associated fees is crucial for effective financial planning. Here’s a breakdown of the key fees:

- Annual Fee: $95.

- Purchase APR: Variable rate, currently 20.49% – 28.49%, based on your creditworthiness.

- Balance Transfer Fee: Either $5 or 5% of the amount of each transfer, whichever is greater.

- Cash Advance Fee: Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Late Payment Fee: Up to $41.

Understanding these fees ensures you can manage your account responsibly and avoid unnecessary charges.

Contacting Citi for Assistance

If you have questions about your application or need assistance managing your account, Citi offers several ways to get in touch:

- Phone Support: Call the customer service line on the back of your card for assistance.

- Online Account Center: Log in to your account at Citi’s website to manage your card and access support.

- Mobile App: Download the Citi Mobile App to manage your account on the go and contact customer service.

Citi ensures that help is always available whenever you need it.

Is It Worth It?

The Citi Strata Premier Card is a fantastic option for individuals who prioritize earning rewards on travel, dining, and everyday purchases. With its generous bonus categories, you can quickly accumulate points for hotels, flights, and other lifestyle expenses.

The added benefit of no foreign transaction fees makes it particularly appealing for frequent travelers who want to save money on international purchases.

One of the standout features is the $100 annual hotel benefit, which can significantly offset the card’s $95 annual fee if used strategically. Additionally, the ability to earn 10 points per dollar on bookings through CitiTravel.com makes it a powerhouse for those who book travel often.

However, it’s essential to plan your spending around these benefits to maximize value.

For individuals who spend heavily on the bonus categories and travel frequently, this card is a top-tier option. While the annual fee and minimum spending requirements for certain perks may not suit everyone, its rewards potential and flexibility make it an excellent choice for maximizing everyday spending.

Ready to boost your rewards game? Apply for the Citi Strata Premier Card today and start enjoying its premium benefits!