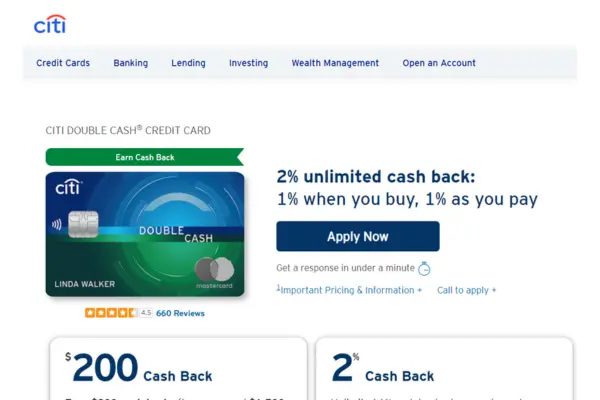

Citi Double Cash Card Apply: Benefits and Advantages!

Discover how to apply for the Citi Double Cash Card and earn unlimited cashback with no annual fee and exclusive benefits.

Anúncios

The Citi Double Cash Card is one of the simplest and most rewarding cashback cards on the market. With unlimited cashback on all purchases and no annual fee, it’s perfect for anyone looking to maximize their everyday spending.

Applying for the card is quick and easy. Let’s go step by step so you can start earning cashback with one of the most popular credit cards available today.

How to Apply for the Citi Double Cash Card

Getting the Citi Double Cash Card is straightforward and can be done online in just a few minutes. Here’s how:

Step-by-Step Guide

- Visit the Citi Website

Head over to the Citi Double Cash Card page to get all the details about the card. - Click “Apply Now”

Look for the “Apply Now” button on the page and click it to begin your application. - Fill Out Your Personal Information

Provide your name, address, date of birth, and contact information. Citi makes the process simple and secure. - Enter Your Financial Details

Add your annual income, employment details, and Social Security Number (SSN). - Review and Submit

Double-check your information, review the terms, and click “Submit.” You’ll usually get a decision within minutes.

Benefits of the Citi Double Cash Card

The Citi® Double Cash Card offers unmatched simplicity and value for everyday spenders. Here’s what makes it stand out:

- Unlimited 2% Cashback

Earn 1% cashback when you make a purchase and an additional 1% when you pay it off. - No Annual Fee

Keep all your cashback without worrying about extra costs. - 0% Intro APR on Balance Transfers

Enjoy 0% intro APR for 18 months on balance transfers (then a variable APR applies). - Flexibility to Redeem Rewards

Redeem your cashback as a statement credit, direct deposit, or check. - Easy-to-Understand Rewards

No rotating categories or spending limits—just straightforward rewards on everything you buy. - Citi Entertainment® Access

Enjoy exclusive access to tickets for concerts, sporting events, and more.

Why the Citi Double Cash Card Is Unique

Unlike many other cashback cards, the Citi® Double Cash Card doesn’t rely on rotating categories or quarterly activations. It’s simple—you earn cashback on every purchase, everywhere. This makes it an excellent choice for anyone who values ease and consistency over complexity.

Additionally, the balance transfer feature adds even more value. If you’re dealing with high-interest debt on other cards, the Citi® Double Cash Card allows you to transfer balances and enjoy 0% APR for 18 months, giving you time to pay it off without extra interest piling up.

Who Should Get the Citi Double Cash Card?

The Citi® Double Cash Card is ideal for:

- Everyday Spenders

If you want a simple card that rewards all your purchases equally, this is a great choice. - People Who Pay in Full

Maximize your 2% cashback by paying off your balance in full each month. - Those Looking to Transfer a Balance

The 0% intro APR on balance transfers can help you consolidate debt. - Budget-Conscious Shoppers

With no annual fee, all your rewards go straight to your pocket.

Fees and Rates

Here’s what you need to know about the costs associated with the Citi Double Cash Card:

- Annual Fee: $0.

- Purchase APR: Variable, typically between 19.24% and 29.24%.

- Balance Transfer Fee: $5 or 3% of the transfer amount, whichever is greater.

- Foreign Transaction Fee: 3%.

Tips to Minimize Costs

- Avoid foreign transaction fees by using a no-fee travel card abroad.

- Pay your balance in full each month to skip interest charges.

- Use the balance transfer option wisely to reduce high-interest debt.

How to Maximize the Citi Double Cash Card

To get the most out of this card, follow these tips:

- Use It for Everyday Spending

With 2% cashback on everything, this card works for groceries, bills, and online shopping. - Pay Off Your Balance Monthly

Earn the second 1% cashback by paying your balance in full. - Take Advantage of Balance Transfers

Use the 0% intro APR period to pay off high-interest credit card debt. - Redeem Rewards Wisely

Opt for statement credits or direct deposits to get the full value of your cashback. - Combine with Other Citi Cards

Pair this card with Citi cards that offer category-specific rewards to maximize your earning potential.

How Does the Citi Double Cash Card Compare to Competitors?

The Citi® Double Cash Card stands out in the crowded cashback card market due to its simplicity and consistent rewards. Here’s how it compares to similar cards:

- Citi vs. Chase Freedom Unlimited®

While the Chase Freedom Unlimited® offers 1.5% cashback on all purchases plus bonuses in specific categories, the Citi® Double Cash Card provides a higher flat rate at 2%. - Citi vs. Capital One Quicksilver®

The Capital One Quicksilver® also offers unlimited cashback but at 1.5%. Additionally, the Citi® Double Cash Card provides more flexible redemption options. - Citi vs. Discover it® Cash Back

Discover it® Cash Back offers rotating 5% cashback categories, but these require activation and have spending limits. Citi’s consistent 2% rate avoids these complications.

Eligibility Requirements

To apply for the Citi® Double Cash Card, you’ll need to meet the following criteria:

- Age: At least 18 years old.

- Residency: Be a U.S. citizen or permanent resident.

- Credit Score: Good to excellent credit (700+ recommended).

- Income: Provide proof of stable income.

Why Choose the Citi Double Cash Card?

This card offers unmatched simplicity and flexibility for people who want to earn cashback on everything. With unlimited rewards and no annual fee, it’s a reliable option for everyday purchases.

The additional balance transfer feature makes it even more valuable for those looking to manage their finances efficiently. If you value straightforward rewards and low fees, this card is hard to beat.

Alternatives to Consider

If the Citi® Double Cash Card isn’t the perfect fit, consider these options:

- Chase Freedom Unlimited®

Earn 1.5% cashback on all purchases with bonus rewards in certain categories. - Capital One Quicksilver Cash Rewards Credit Card

Offers 1.5% unlimited cashback with no annual fee or foreign transaction fees. - Discover it® Cash Back

Earn 5% cashback on rotating categories and match all cashback earned in the first year.

Contact Information

Need help or have questions about your Citi Double Cash Card application? Here’s how to get in touch:

- Customer Service: 1-800-347-4934.

- Website: Visit the Citi Official Site.

Is the Citi Double Cash Card Worth It?

The Citi Double Cash Card is absolutely worth it if you want a straightforward rewards program with no annual fee.

With unlimited 2% cashback on all purchases and no need to worry about categories or caps, it’s perfect for everyday use. Add in the 0% intro APR on balance transfers, and it’s a versatile card for those looking to save money and earn rewards.

Whether you’re shopping for groceries, paying bills, or looking to consolidate debt, the Citi Double Cash Card has you covered. Apply today and start earning cashback on everything you buy!