Chase Sapphire Preferred Card Apply: Benefits and Fees!

Want to apply for the Chase Sapphire Preferred Card? Discover its benefits, fees, rewards, and why it’s a top choice for travelers.

Anúncios

Looking for a credit card that rewards your love for travel and dining? The Chase Sapphire Preferred Card is designed to deliver exceptional value with robust rewards, travel protections, and a generous sign-up bonus.

Whether you’re planning your next vacation or just want to earn points on everyday expenses, this card is a favorite for good reason. In this guide, we’ll cover everything you need to know about the Chase Sapphire Preferred Card, including how to apply, its top benefits, and tips for maximizing its value. Let’s get started!

How to Apply for the Chase Sapphire Preferred Card

Getting the Chase Sapphire Preferred Card is a straightforward process that you can complete online in just a few steps.

Step-by-Step Guide:

- Check Your Credit Score

Make sure your credit score is in the good-to-excellent range (typically 690 or above). This improves your chances of approval. - Visit the Chase Website

Head to the official Chase website and navigate to the Chase Sapphire Preferred Card application page. Double-check that you’re on the right page to avoid confusion with other Chase cards. - Provide Personal Information

Fill out the application form with your details, including name, address, employment status, and annual income. Accuracy is key to a smooth approval process. - Review the Terms

Before submitting, read through the terms and conditions carefully. Pay attention to the annual fee, APR, and reward structure. - Submit Your Application

Once everything is filled out, hit submit! Chase often provides an instant decision, though some applications may require additional review.

Once approved, you’ll receive your card in the mail, ready to start earning rewards.

Top Benefits of the Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is packed with benefits that cater to frequent travelers and savvy spenders alike. Here’s why it’s so popular:

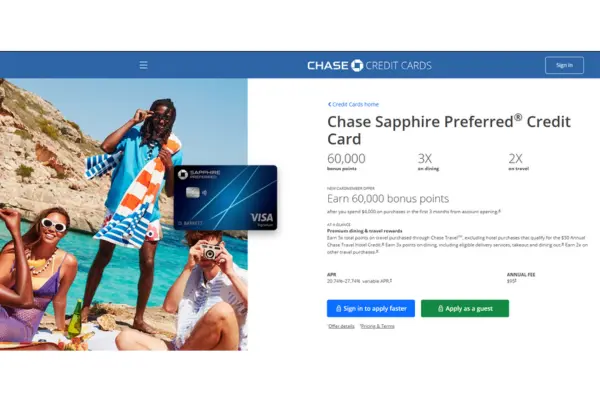

1. Generous Sign-Up Bonus

Earn 60,000 bonus points after spending $4,000 in purchases within the first three months of account opening. When redeemed through Chase Ultimate Rewards®, these points are worth $750 toward travel.

2. High Rewards Rates

- 2x Points on Travel and Dining: Earn double points on all travel and dining purchases, including takeout and eligible delivery services.

- 1x Point on Other Purchases: All other purchases earn 1 point per dollar, making this card a consistent rewards earner.

3. Flexible Redemption Options

With the Chase Ultimate Rewards portal, you can redeem your points for travel, gift cards, or even statement credits. Points are also transferable to over 13 airline and hotel loyalty programs, offering even greater value.

4. No Foreign Transaction Fees

Use your card abroad without worrying about extra charges. This makes it an excellent option for international travelers.

5. Comprehensive Travel Protections

- Trip Cancellation/Interruption Insurance: Get reimbursed for non-refundable travel expenses if your trip is canceled for a covered reason.

- Primary Car Rental Insurance: Avoid extra costs on car rentals with primary coverage for theft and collision damage.

- Baggage Delay Reimbursement: If your bags are delayed, get reimbursed for essential items.

These benefits not only enhance your travel experiences but also provide peace of mind when unexpected events arise.

Fees Associated with the Chase Sapphire Preferred Card

Understanding the fees is crucial to ensuring the Chase Sapphire Preferred Card aligns with your financial goals. Here’s a breakdown:

- Annual Fee: $95. This is relatively low for a card offering such robust travel rewards.

- APR: 20.24% to 27.24% Variable. It’s best to pay off your balance in full each month to avoid interest charges.

- Balance Transfer Fee: 5% of the transferred amount or $5, whichever is greater.

- Cash Advance Fee: $10 or 5% of the transaction amount, whichever is greater.

- Foreign Transaction Fee: None, making it ideal for international spending.

By understanding and planning for these fees, you can avoid surprises and fully capitalize on the card’s advantages.

How to Maximize Your Chase Sapphire Preferred Card Rewards

Earning rewards is only the first step. Here’s how to make the most of your Chase Sapphire Preferred Card:

- Book Through Chase Ultimate Rewards®: Points redeemed for travel through Chase’s portal are worth 25% more, maximizing your rewards.

- Transfer Points to Travel Partners: For potentially greater value, transfer points to partners like United Airlines or Hyatt Hotels.

- Use for Dining and Travel: To maximize your rewards, focus on using your card for purchases in these high-earning categories.

- Combine with Other Chase Cards: Pair it with cards like the Chase Freedom Unlimited® to pool your rewards and optimize earnings.

- Track Spending Habits: Monitor your spending to ensure you’re taking full advantage of reward categories without overspending.

These strategies can significantly increase the value of your points and make every dollar you spend more rewarding.

Who Should Consider the Chase Sapphire Preferred Card?

This card is ideal for:

- Frequent Travelers: If you travel often, the no foreign transaction fees, travel protections, and point transfer options make it a standout choice.

- Dining Enthusiasts: Earn double points on dining, making it great for foodies.

- Points Maximizers: If you want flexibility in redeeming rewards, this card offers excellent value through Ultimate Rewards®.

However, it might not be the best option for those who don’t spend much on travel or dining, as the rewards in other categories are less competitive.

Contacting Chase for Assistance

Need help with your card? Chase offers several convenient ways to get support:

- Phone Support: Call the number on the back of your card for immediate assistance.

- Online Account Access: Log in to your Chase account to manage transactions, make payments, or track rewards.

- Mobile App: Use the Chase mobile app for on-the-go account management and support.

With these options, you’ll have all the tools you need to stay on top of your account.

Is the Chase Sapphire Preferred Card Worth It?

The Chase Sapphire Preferred Card is a standout choice for frequent travelers, dining enthusiasts, and anyone looking to maximize their spending. The sign-up bonus alone offers tremendous value, and the ability to transfer points to travel partners provides flexibility unmatched by many other cards.

While the $95 annual fee might seem daunting, the card’s benefits—like comprehensive travel protections, no foreign transaction fees, and bonus categories—more than justify the cost. However, it’s not ideal for those who don’t spend in these high-earning categories or who prefer straightforward cashback rewards.

For those ready to enhance their travel and dining experiences, the Chase Sapphire Preferred Card is worth every penny. Apply today and start reaping the rewards of smarter spending!