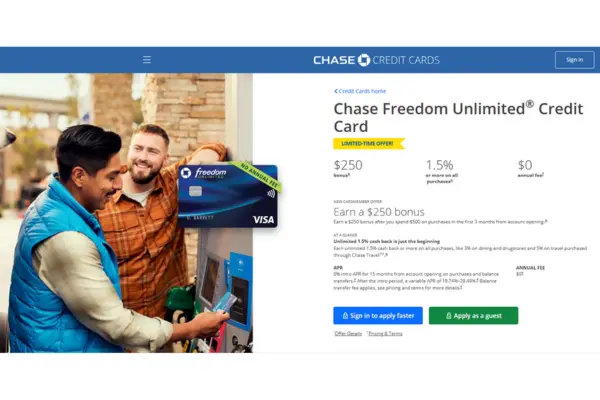

Chase Freedom Unlimited Card Apply: Benefits and Fees!

Learn all about the Chase Freedom Unlimited Card. Explore its benefits, fees, rewards, and why it’s a top cashback card!

Anúncios

Looking for a credit card that delivers simple yet rewarding cashback on your everyday purchases? The Chase Freedom Unlimited Card might be the perfect fit. With its impressive cashback rates, easy-to-understand rewards, and no annual fee, this card stands out for those who want to maximize their spending potential without complications.

In this guide, we’ll break down everything you need to know about the Chase Freedom Unlimited Card, including how to apply, its benefits, fees, and how to make the most of its rewards.

How to Apply for the Chase Freedom Unlimited Card

Applying for the Chase Freedom Unlimited® Card is quick and straightforward. Follow these steps to get started:

Step-by-Step Guide:

- Check Your Credit Score

Ensure your credit score is in the good-to-excellent range (690 or higher). This boosts your chances of approval. - Visit the Chase Website

Navigate to the official Chase website and locate the Chase Freedom Unlimited Card application page. - Fill Out the Application Form

Provide accurate personal details, such as your full name, address, employment status, and annual income. - Review the Terms and Conditions

Carefully read through the card’s terms, including APR rates, fees, and cashback structure, to ensure it aligns with your needs. - Submit Your Application

Once satisfied, submit your application. Chase typically provides a decision quickly, though some cases may require additional review.

After approval, your card will arrive in the mail and you can start earning cashback immediately. See the benefits below now!!!!

Benefits of the Chase Freedom Unlimited Card

The Chase Freedom Unlimited® Card is packed with features that make it one of the most versatile cashback cards available. Here’s why it’s a favorite among users:

1. High Cashback Rates

- 5% Cashback on Travel: Earn 5% on travel purchases made through Chase Ultimate Rewards®.

- 3% Cashback on Dining and Drugstore Purchases: Includes takeout, delivery, and in-store or online drugstore transactions.

- 1.5% Cashback on All Other Purchases: Unlike many cards that offer just 1% on general spending, this card provides a higher base rate.

2. No Annual Fee

Enjoy all the benefits of this card without worrying about paying an annual fee.

3. Generous Introductory Offer

Earn an additional 1.5% cashback on all purchases (up to $20,000 spent in the first year), totaling up to 6.5% on travel, 4.5% on dining and drugstores, and 3% on everything else.

4. Flexible Redemption Options

Redeem cashback as statement credits, gift cards, or travel bookings through Chase Ultimate Rewards®.

5. 0% Introductory APR

Enjoy a 0% introductory APR on purchases and balance transfers for the first 15 months. Afterward, a variable APR of 20.24% to 28.99% applies.

Fees Associated with the Chase Freedom Unlimited Card

Understanding the fees is essential to get the most out of your Chase Freedom Unlimited® Card. Here’s what you need to know:

- Annual Fee: $0. This makes the card highly attractive for budget-conscious users.

- APR: 20.24% to 28.99% Variable after the 15-month introductory period.

- Balance Transfer Fee: Either $5 or 5% of the amount transferred, whichever is greater.

- Foreign Transaction Fee: 3% of each transaction in U.S. dollars. This is worth considering if you frequently travel internationally.

- Cash Advance Fee: $10 or 5% of the transaction amount, whichever is greater.

By planning your spending and paying off balances monthly, you can avoid these fees and make the most of the card’s rewards.

How to Maximize Rewards with the Chase Freedom Unlimited® Card

To fully benefit from the Chase Freedom Unlimited Card, follow these tips to optimize your cashback potential:

- Use for Everyday Purchases: Focus on using your card for dining, drugstore items, and travel booked through Chase to earn higher cashback rates.

- Leverage the Introductory Offer: Max out the first-year cashback bonus by using your card for larger purchases or recurring expenses.

- Pair with Other Chase Cards: Combine your rewards with other Chase cards, like the Sapphire Preferred®, to transfer points to travel partners for higher value.

- Pay Your Balance in Full: Avoid interest charges by paying off your balance each month, especially after the 0% APR introductory period ends.

With a smart spending strategy, you can maximize the value of every dollar spent on this card.

Who Should Consider the Chase Freedom Unlimited Card?

This card is ideal for:

- Everyday Shoppers: If you frequently spend on groceries, dining, or travel, the cashback rates make this card highly rewarding.

- Budget-Conscious Users: With no annual fee and a competitive rewards structure, it’s perfect for those who want to earn cashback without extra costs.

- First-Time Cardholders: The straightforward cashback structure and introductory offer make it a great choice for those new to credit cards.

However, it might not be the best option for international travelers due to the 3% foreign transaction fee.

Contacting Chase for Assistance

Chase provides several ways to assist cardholders with their accounts and inquiries:

- Phone Support: Call the number on the back of your card for quick assistance.

- Online Account Management: Log into your Chase account to manage transactions, redeem rewards, and pay your bill.

- Mobile App: Use the Chase mobile app for convenient account access and customer support.

These support options ensure you can resolve any issues or manage your account efficiently.

Is the Chase Freedom Unlimited Card Right for You?

The Chase Freedom Unlimited Card is a fantastic option for those seeking a straightforward cashback card with no annual fee. Its combination of high cashback rates, a generous introductory offer, and flexible redemption options makes it an excellent choice for everyday spending.

While the foreign transaction fee may limit its appeal for international travelers, the card’s benefits far outweigh its minor drawbacks for domestic users.

With the ability to earn elevated cashback rates on dining, travel, and drugstore purchases, this card is particularly appealing to individuals who value consistent rewards for their regular expenses.

If you’re looking for a reliable, high-reward credit card to complement your lifestyle and simplify your financial management, the Chase Freedom Unlimited Card is a strong contender.

Sign up today to start earning cashback, enjoy the convenience of flexible redemptions, and make the most of your benefits like no annual fees and unmatched fees on your everyday spending!