Blue Cash Preferred Card Apply: Benefits and Network

Learn how to apply for the Blue Cash Preferred Card, its benefits, fees, and if it’s the right fit for your spending needs.

Anúncios

Choosing the right credit card can make managing everyday expenses more rewarding. The Blue Cash Preferred Card from American Express is perfect for families and individuals who spend big on groceries, streaming services, and transit.

Want a card that offers premium cash-back rates and exclusive perks? Let’s dive into how to apply and why this card could be your next financial game-changer.

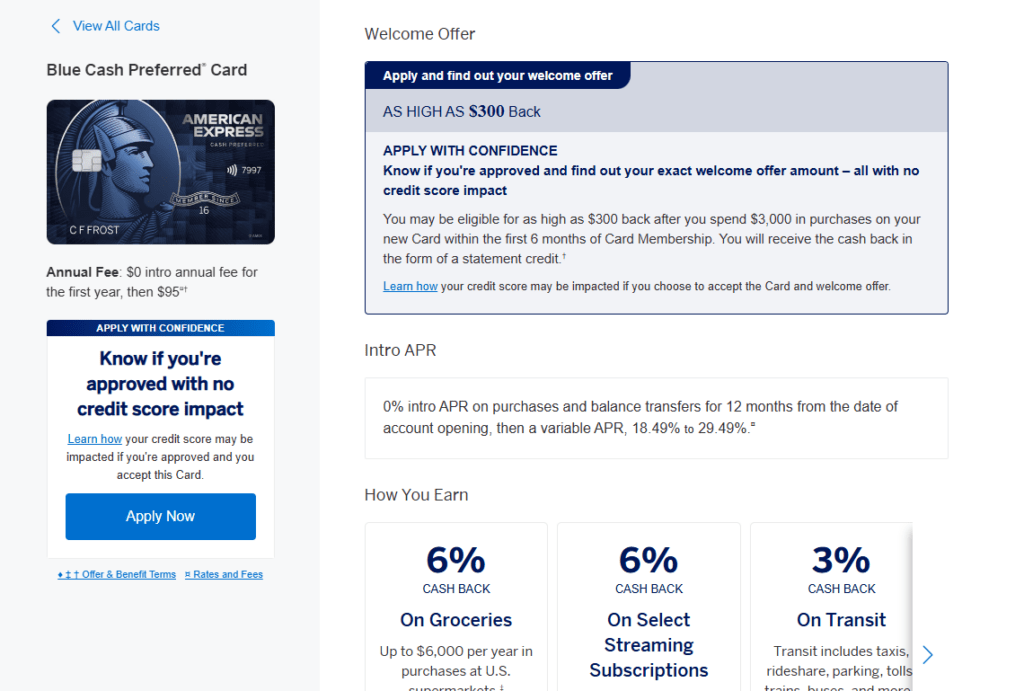

How to Apply for the Blue Cash Preferred Card

Applying for the Blue Cash Preferred Card is quick and hassle-free, making it easy to start earning rewards right away. Whether you’re new to credit cards or upgrading to one with better benefits, the process is straightforward.

Steps to Apply:

- Visit the American Express website: Navigate to the credit card section and find the Blue Cash Preferred Card.

- Click “Apply Now”: Begin the application process by selecting the “Apply Now” button.

- Enter personal details: Provide your full name, date of birth, Social Security number, and contact information.

- Submit financial information: Include details about your annual income, employment status, and housing expenses.

- Consent to a credit check: Agree to the terms and conditions, which include a credit assessment.

- Review and submit: Double-check your details before submitting the application.

Once submitted, American Express will review your application and provide a response within a few days. If approved, your card will arrive in the mail, ready for use.

Why Choose the Blue Cash Preferred Card

The Blue Cash Preferred Card is an excellent choice for those looking to maximize rewards on everyday spending. With high cash-back rates and additional perks, it’s designed to make your money work harder for you.

Key Benefits:

- 6% Cash Back: Earn 6% cash back on U.S. supermarket purchases (up to $6,000 annually, then 1%).

- Streaming Services: Get 6% cash back on select U.S. streaming subscriptions.

- Gas and Transit: Earn 3% cash back at U.S. gas stations and on transit, including rideshare and tolls.

- Welcome Offer: Receive a generous statement credit when you meet the spending threshold within the first six months.

- Introductory APR: Enjoy 0% APR on purchases and balance transfers for the first 12 months, followed by a variable rate.

These benefits make the card ideal for households and individuals who want to save on routine expenses while earning rewards.

Requirements to Apply for the Blue Cash Preferred Card

Before applying, it’s essential to ensure you meet the eligibility requirements for the Blue Cash Preferred Card. Meeting these criteria improves your chances of approval and helps you enjoy the card’s benefits sooner.

Eligibility Criteria:

- Residency: Applicants must be U.S. residents.

- Age: You must be at least 18 years old.

- Credit Standing: A good to excellent credit score (typically 670 or higher) is recommended for approval.

- Income: While there is no disclosed minimum income, higher income increases approval odds.

If you meet these requirements, you’re ready to apply and unlock the benefits of this cash-back powerhouse.

Discounts and Rewards Program

The Blue Cash Preferred Card features one of the most robust cash-back rewards programs available, tailored to maximize your savings on everyday purchases.

Cash-Back Categories:

- 6% on Groceries: Earn 6% cash back at U.S. supermarkets, capped at $6,000 annually (then 1%).

- 6% on Streaming: Eligible streaming services like Netflix, Hulu, and Disney+ earn 6% cash back.

- 3% on Gas and Transit: Fuel up or commute with rideshare and public transit while earning 3% cash back.

- 1% on Everything Else: For all other purchases, earn 1% cash back automatically.

Additional Perks:

- Redeem cash back as statement credits, reducing your monthly bill.

- Disney Bundle Credit: Receive monthly statement credits when you enroll and use your card for the Disney Bundle.

This flexible rewards structure ensures that no matter how you spend, you’re always getting something back.

Advantages and Disadvantages

Like any credit card, the Blue Cash Preferred Card has its pros and cons. Understanding these will help you decide if it aligns with your financial goals.

Advantages:

- High Cash-Back Rates: Leading rates on groceries, streaming, and gas make it a top choice for everyday spending.

- Welcome Offer: Generous introductory rewards for new cardholders.

- Introductory APR: 0% APR for 12 months on purchases and balance transfers.

- Disney Bundle Credits: Save on popular streaming services.

Disadvantages:

- Annual Fee: After the first year, a $95 fee applies.

- Foreign Transaction Fee: A 2.7% fee applies to purchases made outside the U.S.

- Spending Caps: The 6% cash back on groceries is capped at $6,000 annually.

By weighing these factors, you can determine if this card fits your spending habits and financial goals.

What Are the Fees on the Blue Cash Preferred Card?

Understanding the card’s fees will help you avoid surprises and manage your finances effectively.

Fee Breakdown:

- Annual Fee: $0 for the first year, then $95.

- Purchase APR: Variable rates ranging from 18.49% to 29.49% after the introductory period.

- Balance Transfer Fee: Either $5 or 3% of the transfer amount, whichever is greater.

- Cash Advance Fee: $10 or 5% of the amount, whichever is greater.

- Foreign Transaction Fee: 2.7% of the transaction amount.

- Late Payment Fee: Up to $40.

Being aware of these fees ensures that you can use the card responsibly and maximize its benefits.

Contacting American Express for Assistance

If you have questions about your application or need help managing your account, American Express offers several ways to get in touch:

How to Contact:

- Phone Support: Call the customer service line on the back of your card for assistance.

- Online Chat: Use the secure chat feature available on the American Express website.

- Mobile App: Manage your account, view transactions, and contact support directly from the app.

- Email Support: Send inquiries through the secure message center in your online account.

American Express ensures that help is always available whenever you need it.

Is It Worth It?

The Blue Cash Preferred Card is one of the best cash-back credit cards available, particularly for families and individuals who spend heavily on groceries, streaming, and transit. With unmatched cash-back rates and a competitive welcome offer, it’s a smart choice for those who want to make their spending work harder.

However, consider the annual fee after the first year and the foreign transaction fees if you frequently travel abroad. If your spending aligns with the card’s strengths, it’s a top-tier option for maximizing rewards on everyday purchases.

Ready to take the next step? Apply today and start saving with the Blue Cash Preferred Card!