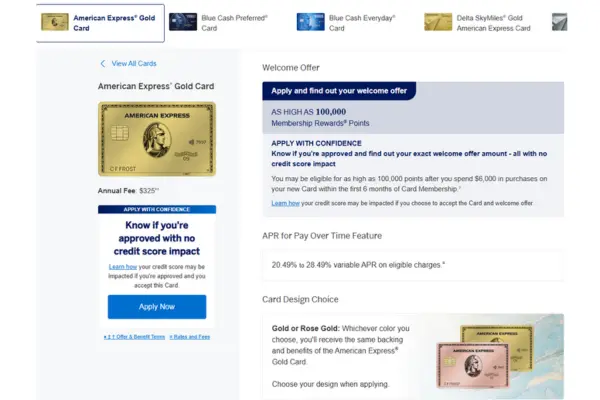

American Express Gold Card Apply: Benefits and Advantages!

Learn how to apply for the American Express Gold Card and enjoy rewards for dining, groceries, and more!

Anúncios

The American Express Gold Card is one of the best credit cards for foodies and travelers alike. It offers high rewards on dining, groceries, and travel, making everyday spending incredibly rewarding.

Applying for the card is quick and easy. With just a few steps, you could start earning Membership Rewards® Points and taking advantage of exclusive benefits. Let’s dive into how you can apply and get the most out of this card.

How to Apply for the American Express Gold Card

Getting the American Express Gold Card is a simple process you can complete online in minutes. Here’s how:

Step-by-Step Guide

Visit the Official American Express Website

Head to the American Express Gold Card page. You’ll find all the details about the card and the “Apply Now” button.

- Click “Apply Now”

Select the “Apply Now” button to start the process. - Enter Your Personal Information

Provide your name, address, email, and phone number. The process is straightforward and secure. - Provide Your Financial Details

Fill in your annual income, employment status, and Social Security Number (SSN). - Review Terms and Conditions

Make sure you understand the card’s rates, fees, and benefits before proceeding. - Submit Your Application

Confirm your details and click “Submit.” Most applicants receive an instant decision!

Benefits of the American Express Gold Card

The American Express Gold Card is packed with perks, especially for those who love dining out or cooking at home. Here are the key benefits:

- 4X Points on Dining

Earn 4X Membership Rewards® Points at restaurants, including takeout and delivery. - 4X Points on Groceries

Shop at U.S. supermarkets and earn 4X points (on up to $25,000 annually). - 3X Points on Travel

Book flights and hotels to earn 3X points on travel purchases. - 1X Points on Everything Else

Every other purchase earns you 1 point per dollar spent. - $120 Dining Credit

Get $10 per month in credits for dining at participating restaurants or food delivery services like Grubhub and Seamless. - No Foreign Transaction Fees

Use your card abroad without worrying about extra charges. - Exclusive Travel Perks

Includes travel insurance, baggage protection, and car rental loss and damage insurance. - Extended Warranty and Purchase Protection

Enjoy additional protection for eligible purchases.

Who Should Get the American Express Gold Card?

This card isn’t for everyone, but if you fall into one of these categories, it’s likely a perfect fit:

- Food Enthusiasts

If you dine out regularly or order takeout often, the 4X points on dining make this card a must-have. - Home Cooks

With 4X points on groceries, it’s one of the best cards for supermarket spending. - Frequent Travelers

The travel perks and 3X points on travel bookings make it great for people who love to explore. - High Spenders

If your monthly expenses include dining, groceries, and travel, the rewards will easily outweigh the annual fee. - Loyalty Program Fans

Membership Rewards® Points can be transferred to numerous airline and hotel loyalty programs for maximum value.

Fees and Rates

It’s important to understand the costs associated with the American Express Gold Card:

- Annual Fee: $250.

- Purchase APR: Variable, depending on your creditworthiness.

- Late Payment Fee: Up to $40.

- Foreign Transaction Fee: None.

Tips to Avoid Fees

- Pay your balance in full every month to skip interest charges.

- Use the $120 dining credit and travel rewards to offset the annual fee.

How to Maximize the American Express® Gold Card

To get the most out of your Gold Card, consider these tips:

- Focus on Dining and Grocery Spending

Use the card for all your food-related expenses to earn 4X points quickly. - Take Advantage of Dining Credits

Use the $120 annual dining credit for meals at participating restaurants and food delivery apps. - Book Travel Through AmEx

Use the American Express Travel portal to earn 3X points on flights and hotels while enjoying exclusive deals. - Transfer Points to Partners

Maximize the value of your Membership Rewards® Points by transferring them to travel partners like Delta, Hilton, or Marriott. - Check the AmEx Offers Portal

Regularly check the American Express app or website for targeted offers that provide extra points or discounts.

Eligibility Requirements

To apply for the American Express Gold Card, you must meet these basic requirements:

- Age: At least 18 years old.

- Residency: Be a U.S. citizen or permanent resident.

- Credit Score: A good to excellent score (700 or higher) is recommended.

- Income: Provide proof of stable income to support your spending habits.

Why Choose the American Express Gold Card?

The American Express Gold Card offers value that goes beyond its rewards program. With a wide range of perks designed to enhance your everyday spending and travel experiences, it’s one of the most well-rounded cards on the market.

Its ability to combine high earning rates, flexible redemption options, and exclusive benefits like dining credits makes it stand out. Whether you’re enjoying a meal at a top restaurant or saving on groceries, the Gold Card ensures you’re always getting something back.

Alternatives to Consider

If the American Express Gold Card isn’t quite the right fit, consider these options:

- Chase Sapphire Preferred Card

Best for those who want flexible travel rewards and no foreign transaction fees. - American Express Green Card

A more affordable option for travelers, with solid travel rewards. - Capital One Savor Rewards Card

Offers cashback rewards for dining and entertainment.

Contact Information

Need assistance or have questions about the American Express Gold Card? Here’s how to get help:

- Customer Support: 1-800-528-4800.

- Website: Visit the American Express Official Site.

Is the American Express Gold Card Worth It?

Without a doubt, the American Express Gold Card is worth considering if you want to earn big rewards on everyday spending.

With 4X points on dining and groceries, no foreign transaction fees, and a range of travel perks, it’s one of the best cards for foodies and travelers. The annual fee may seem high, but the rewards and benefits more than make up for it—especially if you take full advantage of the credits and Membership Rewards® Points.

If you’re ready to make your spending more rewarding, apply today and start enjoying the benefits!