American Express Cobalt Card Apply: Benefits and App!

Anúncios

Learn how to apply for the American Express Cobalt Card, its benefits, fees, and why it’s a top choice for maximizing rewards in Canada.

Choosing the right credit card can help you earn rewards and enjoy exclusive perks. The American Express Cobalt Card is designed for Canadians who want to maximize their spending on dining, travel, and everyday purchases. With flexible points and competitive earn rates, it’s a premium option for savvy cardholders.

Let’s explore how to apply, its benefits, and whether it’s the right fit for your financial goals.

How to Apply for the American Express Cobalt Card

Applying for the American Express Cobalt Card is simple, and the process ensures you can start earning rewards quickly.

Steps to Apply:

- Visit the American Express Website: Navigate to the American Express Cobalt Card page.

- Click “Apply Now”: Select the “Apply Now” button to begin the application.

- Provide Personal Information: Enter your full name, date of birth, Social Insurance Number (SIN), and address.

- Submit Financial Details: Include your employment status, annual income, and housing expenses.

- Agree to Terms: Review and accept the cardholder terms and conditions.

- Review and Submit: Double-check all entered information for accuracy and submit the application.

Once submitted, you’ll receive a response from American Express, typically within minutes. Approved applicants can begin using their virtual card immediately while awaiting the physical card.

Why Choose the American Express Cobalt Card

The American Express Cobalt Card is packed with features that make it stand out as one of the best credit cards for Canadians. Whether you’re a frequent traveler or enjoy dining out, its benefits are tailored to everyday lifestyles.

Key Benefits:

- High Earning Rates: Earn 5 points per dollar spent on eligible food and drink purchases, 3 points on streaming services, 2 points on transit and gas, and 1 point on all other purchases.

- Flexible Points Redemption: Redeem Membership Rewards points for travel, gift cards, statement credits, or purchases through partners.

- Comprehensive Insurance Coverage: Enjoy travel insurance, purchase protection, and extended warranties.

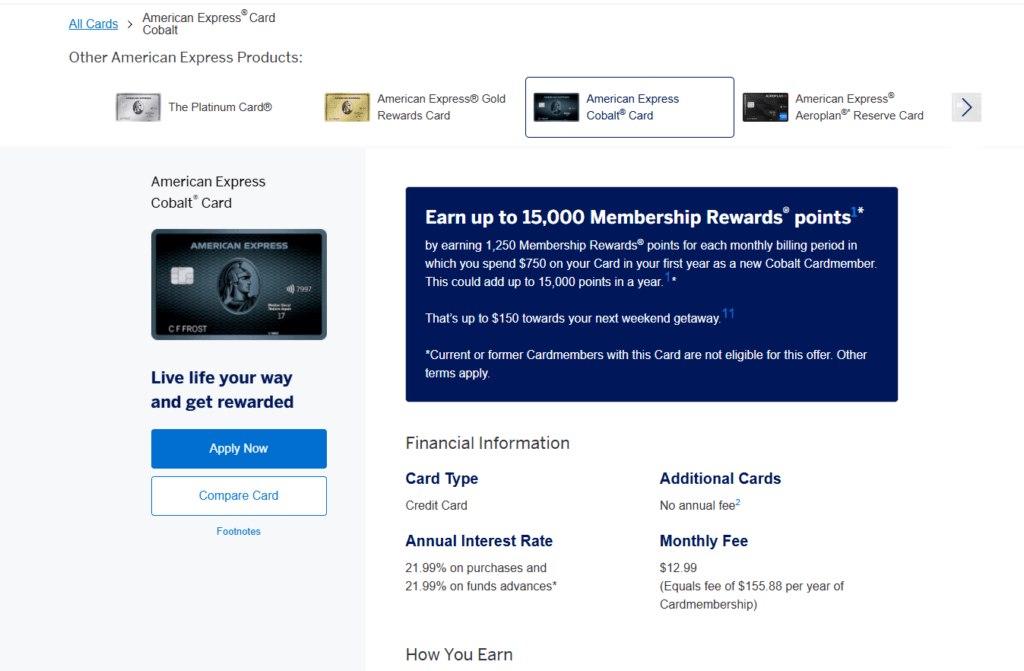

- Welcome Offer: Earn up to 30,000 Membership Rewards points in your first year by meeting spending requirements.

With these features, the American Express Cobalt Card delivers exceptional value to cardholders seeking premium rewards.

Requirements to Apply for the American Express Cobalt Card

Before applying, ensure you meet the basic eligibility criteria for the American Express Cobalt Card.

Eligibility Criteria:

- Residency: Must be a Canadian resident.

- Age: Applicants must meet the age of majority in their province or territory.

- Credit Standing: A good credit score is typically recommended for approval.

- Income: While no minimum income is specified, higher income levels improve approval odds.

Meeting these requirements ensures a smooth and successful application process.

Discounts and Rewards Program

The American Express Cobalt Card offers one of the most competitive rewards programs in Canada. Its tiered earning rates allow cardholders to earn points quickly on their everyday spending.

Points Earning Rates:

- 5 Points per Dollar: On eligible food and drink purchases, including groceries, dining, and food delivery.

- 3 Points per Dollar: On select streaming subscriptions.

- 2 Points per Dollar: On gas, public transit, and ride-sharing services.

- 1 Point per Dollar: On all other purchases.

Redemption Options:

- Travel bookings through the Membership Rewards portal.

- Gift cards for retailers and services.

- Statement credits to offset card purchases.

This structure ensures that you can maximize rewards based on your spending habits.

Advantages and Disadvantages

Like any credit card, the American Express Cobalt Card has its pros and cons. Understanding these can help you decide if it’s the right fit for your financial needs.

Advantages:

- High Points Earning Potential: Exceptional rates on food, dining, and streaming services.

- Flexible Redemption: Use points for travel, statement credits, and more.

- Comprehensive Insurance: Includes travel, purchase, and extended warranty coverage.

- Monthly Fee Structure: The monthly billing at $12.99 makes it more accessible than an upfront annual fee.

Disadvantages:

- Annual Fee: $155.88, billed at $12.99 monthly, which could add up for low spenders.

- Limited Acceptance: Not all merchants accept American Express, especially smaller retailers.

- High Interest Rates: Standard APRs on purchases and cash advances can be costly if balances aren’t paid in full.

Weighing these factors will help you determine if this premium card aligns with your goals.

What Are the Fees on the American Express Cobalt Card?

Understanding the card’s fees is crucial for managing your account responsibly and avoiding unnecessary costs.

Fee Breakdown:

- Annual Fee: $155.88, billed monthly at $12.99.

- Purchase APR: 20.99%.

- Cash Advance APR: 21.99%.

- Foreign Transaction Fee: 2.5% of the transaction amount.

- Late Payment Fee: Up to $30.

By keeping these fees in mind, you can use your card wisely and maximize its value.

Contacting American Express for Assistance

If you have questions about your application or need help managing your account, American Express offers multiple support options:

Contact Options:

- Phone Support: Call the American Express customer service line for assistance.

- Online Chat: Access the chat feature on the American Express website for quick help.

- Mobile App: Manage your account, track rewards, and contact support directly from the app.

- Email Support: Reach out to their team for non-urgent inquiries.

These options ensure you always have access to help when you need it, adding convenience to the cardholder experience.