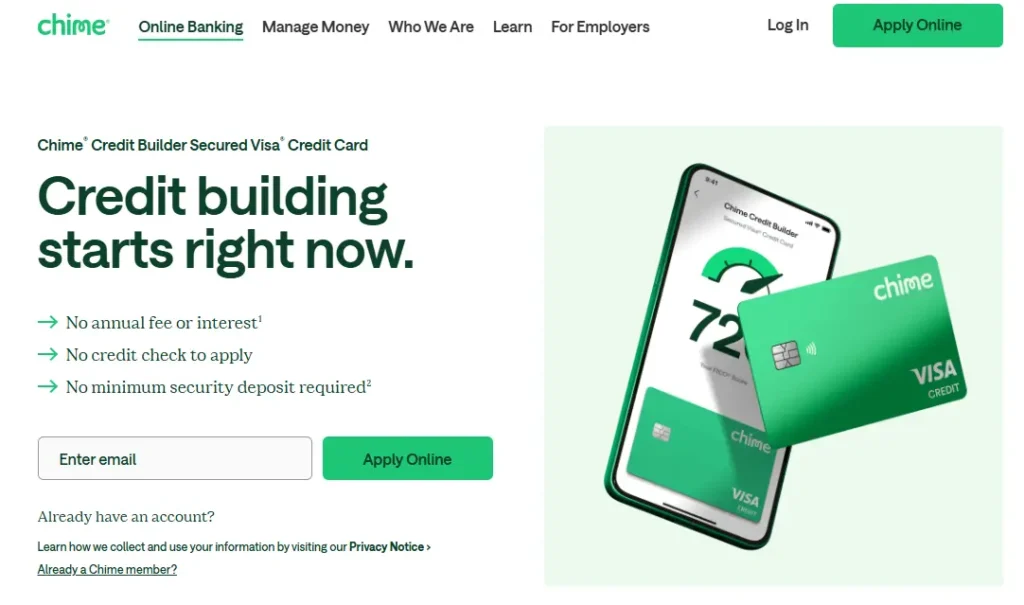

Chime Credit Builder Secured: How to Apply, Requirements, Fees

Anúncios

Learn how to apply for the Chime Credit Builder Secured card, including requirements, fees, and how it helps you build credit with no annual fee.

If you’re looking to build or improve your credit, the Chime Credit Builder Secured card is an excellent choice. With no annual fee and an easy-to-use structure, this secured credit card is designed to help you establish or rebuild your credit score.

In this guide, we’ll walk you through the steps to apply, the card’s requirements, and the fees you should know about before making your decision.

How to Apply for the Chime Credit Builder Secured Card

The Chime Credit Builder Secured card offers a quick and easy application process. Follow these steps to apply and start building your credit today.

Step-by-Step Process

- Sign Up for Chime Account

To apply for the Chime Credit Builder Secured card, you first need to create a Chime account. Visit the Chime website and sign up for an account if you don’t already have one. - Activate the Credit Builder Feature

Once your account is active, navigate to the “Credit Builder” section in your Chime account settings to enable the secured credit card feature. - Fund Your Secured Credit Limit

The card operates on a refundable security deposit, which you can fund with your Chime account balance. The amount you deposit will act as your credit limit, and it’s flexible based on your needs. - Review and Confirm

Review your details, confirm the amount you want to deposit, and complete the application. Once processed, your card will be issued. - Start Using the Card

After your card is activated, you can begin using it for everyday purchases, building your credit as you go.

Applying for the Chime Credit Builder Secured card is easy and quick, allowing you to start building your credit almost immediately.

Requirements for the Chime Credit Builder Secured Card

The Chime Credit Builder Secured Card is designed to be accessible for a wide range of individuals, especially those new to credit or looking to rebuild. Here are the basic requirements you’ll need to meet in order to apply:

Eligibility Criteria

- Chime Account: You must have an active Chime account. If you don’t have one, you’ll need to sign up for it first.

- Security Deposit: You’ll need to fund your secured credit limit through your Chime account balance. The minimum deposit is $200, and you can increase it up to $5,000 depending on your needs.

- No Credit Check: The Credit Builder Secured Card doesn’t require a credit check to apply, which makes it an ideal option for those with no credit history or low credit scores.

- U.S. Resident: You need to be a U.S. resident to apply for the card.

These requirements make the Chime Card an accessible and straightforward option for people looking to start or rebuild their credit.

Fees and Charges of the Chime Credit Builder Secured Card

This card has minimal fees, making it a cost-effective option for those looking to build or improve their credit.

- Annual Fee: $0

- Interest Rate (APR): 0% (no interest charged on purchases)

- Late Payment Fee: $0

- Foreign Transaction Fee: $0

- Cash Advance Fee: $0

The Chime Credit Builder Secured card is great for those who want to avoid the typical fees that come with many other secured credit cards.

By offering no annual fee, interest charges, or late fees, this card allows you to focus on building your credit without worrying about extra costs.

How to Maximize Credit Building with the Chime Credit Builder Secured Card

To make the most of your Credit Builder Secured card, follow these simple strategies to ensure you’re building credit effectively:

Tips for Maximizing Your Credit Score

- Make Payments on Time: Ensure you make your payments on time each month to avoid any negative impacts on your credit score.

- Keep Your Credit Utilization Low: Aim to use only a small portion of your available credit limit to maintain a low credit utilization rate.

- Set Up Automatic Payments: Automate your payments to avoid missing due dates, ensuring you stay on track.

- Monitor Your Credit: Use the Chime app to track your spending and ensure you’re staying within your budget.

By following these tips, you can make the most of this card and steadily improve your credit score.

Who Should Consider the Chime Credit Builder Secured Card?

The Chime Credit Builder Secured card is ideal for a variety of individuals who are looking to build or rebuild their credit.

Ideal For:

- First-Time Credit Users: If you’re new to credit, this card is a great way to start building a positive credit history without worrying about high fees.

- Individuals Rebuilding Their Credit: For those looking to improve their credit score after financial setbacks, this card is a solid tool for rebuilding.

- Budget-Conscious Individuals: With no annual fees or interest charges, the card is perfect for those who want to avoid unnecessary costs while building credit.

If you’re looking for an affordable, simple way to build or improve your credit, the card is a great choice.

Contacting Chime for Assistance

Chime offers several convenient ways to reach out for support if you need help with your Credit Builder Secured Card.

Contact Options

- Phone Support: Call Chime’s customer support for immediate assistance.

- Mobile App: Manage your account, track your spending, and get support directly through the Chime app.

- Email Support: Send an email to Chime’s customer service for non-urgent inquiries.

Whether you need help with your card or have questions about your account, Chime offers multiple contact options to ensure you get the support you need quickly.

Is the Chime Credit Builder Secured Card Worth It?

The Chime Card is a highly affordable and effective option for anyone looking to build or improve their credit. With no annual fee, no interest charges, and a simple deposit process, it stands out as one of the most cost-effective secured credit cards available.

The ability to avoid interest and late fees while building your credit history makes this card especially attractive for first-time credit users and those rebuilding their credit.

In addition to its affordability, the Credit Builder Secured Card offers a straightforward approach to improving your credit. By making timely payments and keeping your balance low, you can steadily increase your credit score over time.

The card’s integration with the Chime mobile app makes it easy to track your spending and payments, ensuring you stay on top of your credit-building goals.

While the Credit Builder Secured Card doesn’t offer traditional rewards like cashback, its zero-fee structure and emphasis on credit building make it a valuable tool for individuals looking to establish or strengthen their credit.

If you’re focused on building a better credit profile with no hidden costs, this card is definitely worth considering.