Firstcard® Secured Credit Builder: How to Apply and Benefits

Learn how to apply for the Firstcard® Secured Credit Builder and start building your credit today. Discover its benefits, fees, and rewards!

Anúncios

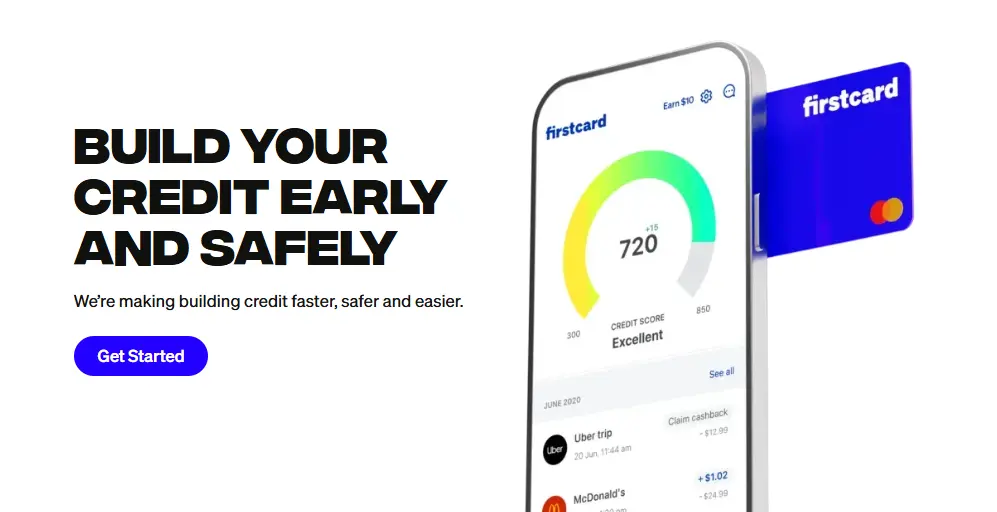

The Firstcard® Secured Credit Builder is an excellent option for individuals looking to build or repair their credit. Whether you’re new to credit or rebuilding after financial setbacks, this secured card can help you establish a solid credit history.

In this article, we’ll guide you through how to apply for the Firstcard® Secured Credit Builder, explain its top benefits, and provide helpful tips on maximizing the card’s features to achieve your financial goals.

How to Apply for the Firstcard® Secured Credit Builder

Applying for the Secured Credit Builder is a straightforward process, and it’s designed to be accessible even for those new to credit. Here’s how you can get started with your application.

Step-by-Step Process

- Check Your Credit Score

It’s a good idea to review your credit score before applying, as it gives you an idea of where you stand. This will help you understand what kind of deposit you might need for approval. - Visit the Official Website

Head to the Firstcard® website, where you can find the application page for the Secured Credit Builder card. It’s easy to navigate, and you’ll find all the details you need. - Fill Out the Application

Provide your basic information, such as name, address, SSN (Social Security Number), and employment details. Additionally, you’ll need to specify the amount of your security deposit. - Review the Terms and Conditions

Take a moment to read through the terms of the card, including the interest rates (APR) and any applicable fees. This ensures you fully understand the costs associated with the card. - Submit Your Application

After reviewing everything, submit your application. In most cases, you will receive a decision right away, but in some instances, additional documentation may be required. - Wait for Your Card

Once approved, your Firstcard® Secured Credit Builder will be sent to you within a few business days. After receiving it, activate the card and start using it to build your credit.

By following these steps, you can easily apply for the Firstcard® Secured Credit Builder and begin your journey toward better credit.

Benefits of the Firstcard® Secured Credit Builder

This card offers several key benefits that make it an ideal choice for those looking to establish or improve their credit history.

Cashback

The Firstcard® Secured Credit Builder allows you to earn cashback on your purchases, providing extra value for your spending. This can help offset the costs of maintaining your card and create a positive credit history.

No Annual Fee

One of the standout features of this card is the lack of an annual fee, which makes it an affordable option for individuals looking to build their credit without the burden of extra costs.

Low Deposit Requirement

Unlike some other secured credit cards, the Firstcard® Secured Credit Builder has a relatively low deposit requirement, which makes it more accessible to individuals who are just starting out or have a limited budget.

Credit Building

Using the Firstcard® Secured Credit Builder responsibly will help improve your credit score over time. As long as you make timely payments and keep your balance low, you’ll be on the path to building a solid credit history.

Easy Account Management

Managing your account is simple with Firstcard®‘s online banking platform. You can easily track your spending, monitor your credit score, and make payments all from one place.

Fees and Rates of the Firstcard® Secured Credit Builder

- Annual Fee: $0

- Minimum Deposit: $200 (can go up to $5,000)

- Foreign Transaction Fee: 3% of each transaction in U.S. dollars

- APR: 24.99% (Variable)

- Late Payment Fee: $38

How to Maximize Rewards with the Firstcard® Secured Credit Builder

To make the most of your Secured Credit Builder, follow these strategies to earn rewards and improve your credit score.

Tips to Maximize Rewards

- Pay On Time: Always make timely payments to avoid late fees and interest charges, while also boosting your credit score.

- Keep Your Balance Low: Try to keep your balance well below your credit limit to ensure that you maintain a low credit utilization rate.

- Use Your Card Regularly: Make purchases on your card regularly to earn cashback and build a history of responsible credit use.

- Track Your Spending: Use Firstcard®’s online tools to track your purchases and ensure that you’re staying within your budget.

By following these strategies, you’ll be able to make the most of your Firstcard® Secured Credit Builder and achieve your credit-building goals.

Who Should Consider the Firstcard® Secured Credit Builder?

This card is ideal for individuals who are looking to establish or improve their credit score, especially those who are new to credit or have a limited credit history.

Ideal For:

- First-Time Credit Users: If you’re just starting out and want to build a strong credit foundation, this card is a great option.

- Those Rebuilding Their Credit: If you’ve faced financial challenges in the past, this card can help you rebuild your credit over time.

- Budget-Conscious Individuals: With no annual fee and a low deposit requirement, this card is affordable for those on a budget.

The Firstcard® Secured Credit Builder is a fantastic choice for those looking to build or rebuild their credit without the extra costs associated with many other credit cards.

Getting in Touch

If you have any questions or need assistance with your Secured Credit Builder offers multiple ways to get in touch with their customer support team.

Contact Options

- Phone Support: Call the customer service number for immediate assistance with your account.

- Online Banking: Manage your account through Firstcard®’s online banking portal.

- Mobile App: Use the mobile app for easy access to your account, wherever you are.

- Email Support: Send an email for non-urgent inquiries.

Whether you need help managing your account or have questions about your rewards, Firstcard® offers several convenient ways to get the support you need.

Is the Firstcard® Secured Credit Builder Worth It?

The Secured Credit Builder offers an affordable and effective way for individuals to build or rebuild their credit. With no annual fee and a low minimum deposit requirement, it is a great option for those who are new to credit or looking to improve their credit history.

The card’s simple structure makes it accessible and easy to use, helping you stay on top of your credit-building goals.

Additionally, the cashback rewards on everyday purchases make the Secured Credit Builder an attractive choice for anyone looking to earn rewards while establishing a solid credit profile.

With responsible use, such as making on-time payments and maintaining a low balance, you can gradually build your credit score and benefit from the card’s rewards program.

However, for those who travel internationally, the 3% foreign transaction fee could be a downside. Still, if your goal is to build credit with no annual fee and the added benefit of cashback, the Secured Credit Builder is definitely worth considering.