U.S. Bank Cash+® Secured Visa®: How to Apply

Anúncios

Discover how to apply for the Bank Cash+® Secured Visa®, U.S. Bank and start building your credit while earning cashback. Learn the benefits, fees, and rewards!

The U.S. Bank Cash+® Secured Visa® is perfect for building or improving your credit while earning cashback on everyday purchases. With customizable cashback categories and low fees, it helps you strengthen your credit score and maximize rewards. Ideal for both newcomers to credit and those rebuilding their credit history.

In this guide, we’ll show you how to apply for the U.S. Bank Cash+® Secured Visa®, explore the benefits, and discuss how to maximize your rewards with this powerful financial tool.

How to Apply for the U.S. Bank Cash+® Secured Visa®

Applying for the U.S. Bank Cash+® Secured Visa® is a simple process that can be completed online. Below are the steps to guide you through the application.

Step-by-Step Process

- Check Your Credit Score

While your credit score won’t necessarily affect your approval, it’s a good idea to know where you stand. A higher score may result in a higher deposit requirement. - Visit the U.S. Bank Website

Go to the official U.S. Bank website and select the Cash+® Secured Visa® card. This will take you to the application page. - Fill Out the Application

Complete the form with your personal information, employment details, and desired deposit amount. This deposit will determine your credit limit. - Review the Terms

Take a moment to review the card’s terms and conditions, including the APR, rewards structure, and fees. - Submit Your Application

After reviewing your information, submit the application. You will receive a decision quickly in most cases. - Wait for Your Card

Once approved, your card will arrive in 7-10 business days. You can then activate it and start using it.

By following these simple steps, you can easily apply for the U.S. Bank Cash+® Secured Visa® and start earning rewards.

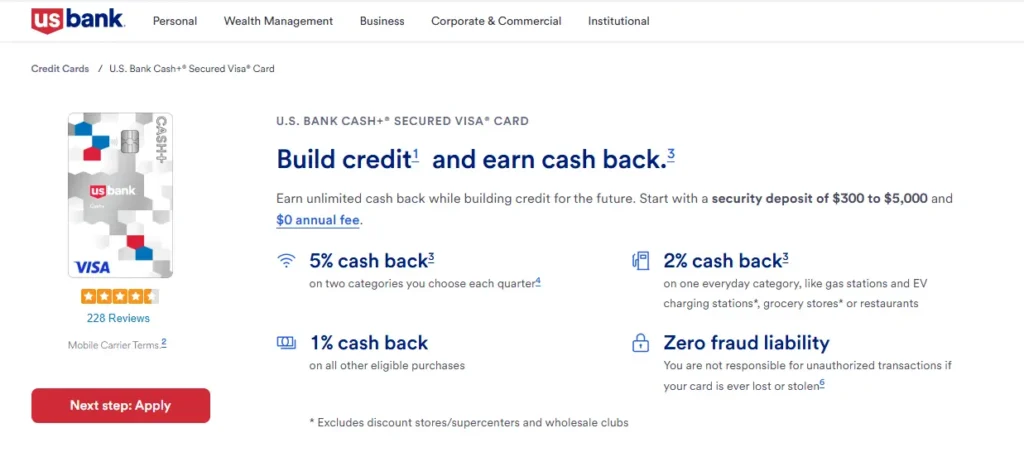

Benefits of the U.S. Bank Cash+® Secured Visa®

The U.S. Bank Cash+® Secured Visa® offers several key benefits that make it a valuable option for those looking to build their credit while earning rewards.

Cashback

The U.S. Bank Cash+® Secured Visa® offers customizable cashback categories, allowing you to earn 5% back on the first $2,000 spent in two categories of your choice each quarter. You’ll also earn 2% back on one category and 1% on all other purchases.

No Annual Fee

This card has no annual fee, which means you can enjoy the benefits of cashback rewards without worrying about additional yearly costs.

APR

The U.S. Bank Cash+® Secured Visa® offers an introductory APR of 0% for the first 12 billing cycles on purchases and balance transfers. After the introductory period, the APR ranges from 18.24% to 28.24%, depending on your creditworthiness.

Online Banking

Easily manage your U.S. Bank Cash+® Secured Visa® through the U.S. Bank online banking portal or mobile app. You can track your spending, make payments, and redeem your rewards with ease.

Rewards Program

The U.S. Bank Cash+® Secured Visa® allows you to earn cashback on your purchases, which can be redeemed for statement credits or used toward other rewards. This program is a great way to make the most out of your spending.

Fees and Rates of the Card

- Annual Fee: $0

- Balance Transfer Fee: 3% of the amount transferred or $5, whichever is greater

- Foreign Transaction Fee: 3% of each transaction in U.S. dollars

- Cash Advance Fee: $10 or 5% of the transaction amount, whichever is greater

- APR: 18.24% to 28.24% (Variable)

How to Maximize Rewards with the U.S. Bank Cash+® Secured Visa®

To get the most out of your U.S. Bank Cash+® Secured Visa®, it’s essential to be strategic with your spending. Below are some tips to help you maximize your rewards:

Tips to Maximize Rewards

- Choose the Right 5% Categories: Select categories where you spend the most each quarter to earn the maximum cashback.

- Track Your Spending: Monitor how much you’ve spent in each category to stay within the cashback limit.

- Combine with Preferred Rewards: If you are eligible for U.S. Bank‘s Preferred Rewards program, you can increase your cashback by up to 25%.

- Use the 0% APR Period: Take advantage of the introductory 0% APR period for large purchases or balance transfers.

By following these strategies, you can optimize your rewards and get the most out of the U.S. Bank Cash+® Secured Visa®.

Who Should Consider the U.S. Bank Cash+® Secured Visa®?

The U.S. Bank Cash+® Secured Visa® is perfect for individuals who want to build or improve their credit score while earning rewards. Here’s who should consider applying for this card:

Ideal For:

- Those New to Credit: This secured card is an excellent option for individuals who are new to credit and want to build a solid credit history.

- People Rebuilding Their Credit: If you need to improve your credit score, this card can help you get back on track.

- Cashback Enthusiasts: The customizable cashback categories make it perfect for individuals who want to earn rewards on their everyday purchases.

- Budget-Conscious Individuals: With no annual fee, this card is a great option for those looking to avoid extra costs.

The U.S. Bank Cash+® Secured Visa® is ideal for anyone looking to improve their credit while earning valuable rewards.

Getting in Touch

If you need help with your U.S. Bank Cash+® Secured Visa®, U.S. Bank provides multiple ways to get in touch with their customer support team.

Contact Options

- Phone Support: Call the number on the back of your card for immediate assistance.

- Online Banking: Use U.S. Bank’s online banking portal to manage your account and track your rewards.

- Mobile App: Download the U.S. Bank mobile app for on-the-go account management.

- Branch Assistance: Visit a U.S. Bank branch for in-person help with your account.

U.S. Bank offers various contact options to ensure you get the support you need quickly and efficiently.

Is the U.S. Bank Cash+® Secured Visa® Worth It?

The U.S. Bank Cash+® Secured Visa® offers a great opportunity for individuals looking to build or rebuild their credit while enjoying valuable cashback rewards. With no annual fee, it stands out as one of the most affordable secured credit cards available.

The customizable cashback categories allow you to tailor the rewards to your everyday spending, which can result in substantial savings over time. If you’re someone who consistently spends in certain categories like gas or groceries, this card can help you earn cashback on those purchases.

In addition to its cashback features, the card provides an introductory 0% APR on purchases and balance transfers for the first 12 months. This is a significant advantage, especially if you plan on making larger purchases or transferring balances from high-interest cards.

The lack of an annual fee combined with a solid cashback program makes this card a highly cost-effective option for credit building.

However, it may not be the best fit for everyone. The Bank Cash+® Secured Visa®, U.S. Bank comes with a foreign transaction fee, which could make it less ideal for frequent travelers. Still, if your goal is to build or improve your credit while earning rewards on your everyday spending, this card is certainly worth considering.

With responsible use, you can enjoy the benefits of cashback rewards while gradually strengthening your credit profile.