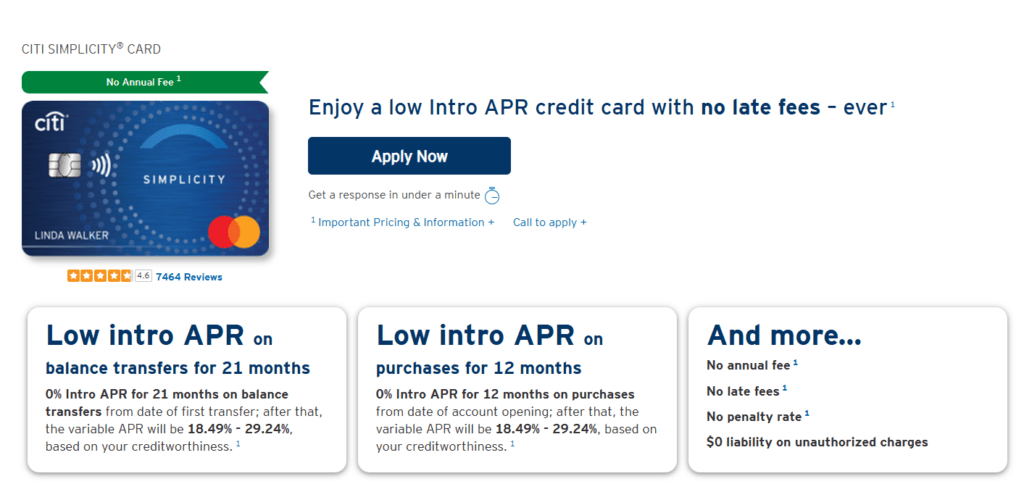

Citi Simplicity Apply – Benefits and Fees!

Anúncios

Discover how to apply for the Citi Simplicity Card, its no-fee benefits and why it’s perfect for managing finances stress-free.

Choosing a credit card that prioritizes simplicity and affordability is crucial for effective financial management. The Citi Simplicity Card eliminates common worries with no late fees, no annual fee, and no penalty APR.

Designed to streamline your credit experience, this card also offers one of the longest 0% introductory APR periods in the market.Let’s explore the application process, its features, and how it can help you simplify your finances.

How to Apply for the Citi Simplicity Card

Applying for the Citi Simplicity Card is a quick and straightforward process that allows you to start managing your finances efficiently.

Steps to Apply the Citi Simplicity Card:

- Visit the Official Citi Website: Navigate to the Citi Simplicity Card page.

- Click “Apply Now”: Begin your application process by selecting the “Apply Now” button.

- Enter Personal Information: Fill in your full name, date of birth, Social Security number, and current address.

- Submit Financial Details: Provide employment status, annual income, and monthly housing expenses to determine your creditworthiness.

- Agree to Terms and Conditions: Review the terms carefully and accept them before proceeding.

- Submit the Application: Ensure all details are accurate, then submit your application.

Citi typically provides an instant decision. If approved, your card will arrive by mail within 7 to 10 business days.

Why Choose the Citi Simplicity Card

The Citi Simplicity Card stands out for its unique approach to credit management, focusing on ease of use and flexibility.

Key Benefits:

- No Late Fees: Forget about penalties for missed payments—this card ensures you won’t face late fees, ever.

- No Penalty APR: Your interest rate won’t increase due to late payments, providing peace of mind in case of occasional delays.

- No Annual Fee: Enjoy all the benefits of the card without paying an annual fee.

- Extended 0% APR: Benefit from a 0% introductory APR on balance transfers for 21 months and on purchases for 12 months. Afterward, a variable APR of 19.24% to 29.99% applies based on your credit score.

- Flexible Payment Options: Choose your due date to better align with your financial schedule.

These features make the Citi Simplicity Card ideal for users who value simplicity and savings.

Requirements to Apply for the Citi Simplicity Card

Before applying, ensure you meet the basic eligibility criteria to avoid delays or rejections.

Eligibility Criteria:

- Age: Applicants must be at least 18 years old (19 in Alabama and Nebraska, 21 in Puerto Rico).

- Residency: You must be a U.S. resident with a valid Social Security number.

- Credit Standing: A good to excellent credit score (typically 670 or higher) is recommended.

- Income: Sufficient income to support your credit obligations is required.

Meeting these criteria ensures a smooth application process and increases your likelihood of approval.

Discounts and Additional Features

Although the Citi Simplicity Card doesn’t offer a rewards program, it provides valuable features that make it a practical choice for many users.

Key Features:

- Zero Liability on Fraudulent Charges: Protects you from unauthorized transactions.

- Balance Transfer Benefits: Transfer high-interest balances to the Citi Simplicity Card to take advantage of the extended 0% APR period.

- Dedicated Customer Service: Citi offers 24/7 support to address your credit card needs.

While it lacks rewards, its features focus on simplifying your credit management and reducing costs.

Advantages and Disadvantages

Understanding the pros and cons of the Citi Simplicity Card can help you decide if it aligns with your financial goals.

Advantages:

- No Fees: With no late fees, penalty APR, or annual fee, this card eliminates many common costs.

- Extended Introductory APR: The 21-month 0% APR on balance transfers is among the longest in the market.

- User-Friendly Features: Flexible payment options and fraud protection enhance convenience and security.

Disadvantages:

- No Rewards Program: The card doesn’t earn points, miles, or cash back.

- Balance Transfer Fee: A fee of 3% (minimum $5) applies for transfers made within the first 4 months, increasing to 5% thereafter.

- High Variable APR: Once the introductory period ends, APRs can go as high as 29.99%, which is costly if balances aren’t paid in full.

Weighing these factors will help you determine if this card fits your financial strategy.

What Are the Fees on the Citi Simplicity Card?

Understanding the fees associated with the Citi Simplicity Card helps you manage your finances effectively and avoid unexpected charges. With its clear and transparent fee structure, this card stands out as a practical choice for those who want to keep costs under control.

Fee Breakdown:

- Annual Fee: $0. You can enjoy the benefits of the card without worrying about an annual cost.

- Balance Transfer Fee: 3% of each transfer (minimum $5) for transfers made within the first 4 months; 5% thereafter. While this fee can add up, the extended 0% introductory APR period helps offset the cost for those consolidating debt.

- Foreign Transaction Fee: 3% of each transaction in U.S. dollars. This fee makes the card less ideal for frequent international travelers, so plan accordingly.

- Late Payment Fee: None—this is a standout feature of the Citi Simplicity Card and provides peace of mind for occasional late payments.

- Cash Advance Fee: Either $10 or 5% of the amount, whichever is greater. Cash advances should be used sparingly due to the high fees and interest rates associated with them.

By understanding these fees, you can effectively plan your usage to maximize the card’s benefits while avoiding unnecessary costs.

Contacting Citi for Assistance

Citi provides multiple ways to support you throughout your credit card journey, ensuring you have access to help whenever needed. Their customer service options are designed to cater to various preferences, making it easy to get assistance.

Contact Options:

- Phone Support: Call the number on the back of your card for immediate assistance. Citi’s dedicated team is available to help with account inquiries, disputes, and card benefits.

- Online Banking: Manage your card, review transactions, and make payments through the Citi online account portal. The platform is user-friendly and provides detailed insights into your spending and balances.

- Mobile App: The Citi Mobile App offers convenient access to your account, allowing you to check balances, track spending, and contact customer support directly. Additionally, the app includes features like bill reminders to help you stay on top of payments.

These comprehensive support options ensure you can manage your account efficiently and resolve issues quickly, enhancing your overall cardholder experience.

Is It Worth It?

The Citi Simplicity Card is a standout option for individuals focused on reducing costs and simplifying credit management. Its no late fees, no penalty APR, and no annual fee make it a worry-free card for everyday use, particularly for those who prioritize financial flexibility.

The extended 0% introductory APR period is ideal for transferring balances or financing significant purchases, giving cardholders ample time to pay down debt interest-free. This feature makes it particularly attractive for those consolidating high-interest debt from other cards. However, frequent travelers may find the foreign transaction fee limiting, and users seeking a rewards program might consider alternative options.

Overall, if your primary goal is managing balances and avoiding fees, the Citi Simplicity Card delivers unmatched value. Its straightforward features and lack of penalties provide peace of mind for everyday financial management. Apply today to take advantage of its benefits and simplify your financial life while saving money.