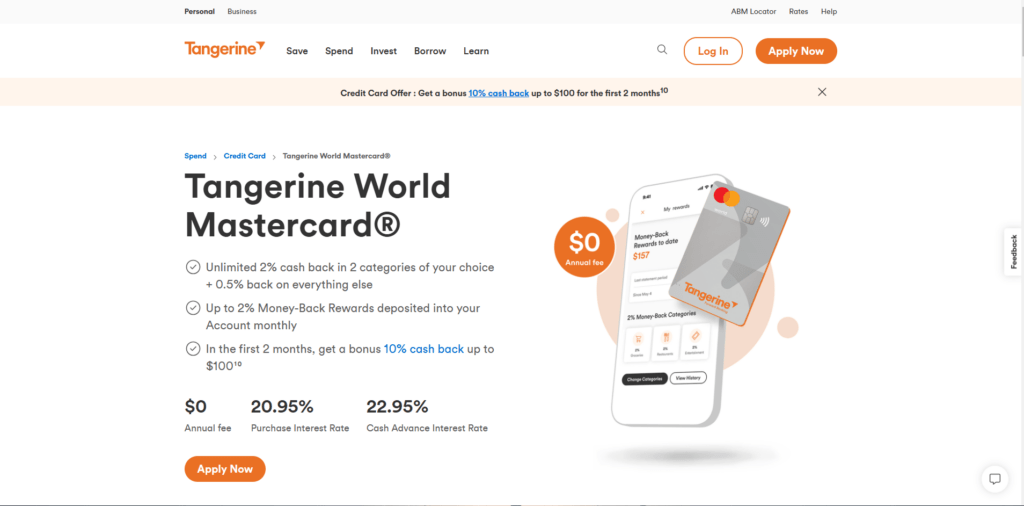

Tangerine World Mastercard Apply: Benefits and Costs

Anúncios

Discover how to apply for the Tangerine World Mastercard, its benefits, fees, requirements, and determine if it’s the right fit for your financial needs.

Obtaining a credit card that aligns with your financial goals can be a game-changer. The Tangerine World Mastercard offers a blend of cash-back rewards, travel perks, and comprehensive insurance coverage, making it a compelling option for many.

If you’re considering this card, understanding the application process, benefits, and associated fees is crucial. Let’s delve into the details to help you make an informed decision.

How to Apply for the Tangerine World Mastercard

Applying for the Tangerine World Mastercard is a straightforward process that can be completed online, ensuring convenience and efficiency. Here’s a step-by-step guide to assist you:

- Visit the Tangerine Website: Navigate to the official Tangerine website and locate the credit cards section.

- Select the World Mastercard: Choose the Tangerine World Mastercard from the available options.

- Initiate the Application: Click on the “Apply Now” button to begin the application process.

- Provide Personal Information: Enter your full name, date of birth, and contact details.

- Submit Financial Details: Include information about your employment status, annual income, and housing expenses.

- Consent to a Credit Check: Agree to the terms and conditions, which include a credit assessment.

- Review and Submit: Double-check all entered information for accuracy and submit your application.

After submission, Tangerine will review your application and notify you of the outcome, typically within a few business days. If approved, your new card will be mailed to you promptly.

Why Choose the Tangerine World Mastercard

The Tangerine World Mastercard stands out due to its array of benefits tailored to enhance your financial experience. Here’s an overview of what makes this card appealing:

- No Annual Fee: Enjoy the perks of a premium credit card without the burden of an annual fee.

- Customizable Cash-Back Rewards: Earn 2% cash back in up to three categories of your choice, such as groceries, gas, or entertainment. All other purchases earn 0.5% cash back.

- Mobile Device Insurance: Receive up to $1,000 in coverage for your mobile devices against damage or theft.

- Rental Car Collision/Loss Damage Insurance: Benefit from protection when renting vehicles, covering potential damages or losses.

- Mastercard Travel Pass: Access over 1,300 airport lounges worldwide at a discounted rate, enhancing your travel comfort.

- On-Demand and Subscription Services: Enjoy special offers and benefits from various on-demand apps and subscription services.

These features collectively provide a robust package for cardholders seeking value and flexibility in their credit card choice.

Requirements to Apply for the Tangerine World Mastercard

Before applying, it’s essential to ensure you meet the eligibility criteria for the Tangerine World Mastercard. The primary requirements include:

- Minimum Income: A personal annual income of at least $60,000 or a household income of $100,000.

- Residency: Must be a Canadian resident.

- Age: Must be the age of majority in your province or territory.

- Credit Standing: A good credit score is typically required for approval.

Meeting these criteria increases the likelihood of a successful application and access to the card’s benefits.

Discounts and Rewards Program

The Tangerine World Mastercard offers a flexible rewards program designed to maximize your cash-back earnings based on your spending habits. Key aspects of the program include:

- 2% Cash Back in Selected Categories: Choose up to three categories where you’ll earn 2% cash back. Options include:

- Groceries

- Gas

- Restaurants

- Entertainment

- Public Transportation and Parking

- 0.5% Cash Back on All Other Purchases: For purchases outside your selected categories, earn a standard 0.5% cash back.

- Monthly Payouts: Cash-back rewards are calculated monthly and can be applied directly to your credit card balance or deposited into your Tangerine Savings Account.

This structure allows you to tailor your rewards to align with your spending patterns, maximizing the value you receive from everyday purchases.

Advantages and Disadvantages

Understanding the pros and cons of the Tangerine World Mastercard will help you assess its suitability for your financial needs.

Advantages:

- No Annual Fee: Enjoy all the card’s benefits without an annual cost.

- Flexible Cash-Back Categories: Customize your rewards to match your spending habits.

- Comprehensive Insurance Coverage: Benefit from mobile device and rental car insurance.

- Travel Perks: Access airport lounges and enjoy travel-related discounts.

Disadvantages:

- Income Requirements: The card’s income thresholds may be prohibitive for some applicants.

- Foreign Transaction Fee: A 2.5% fee applies to purchases made in foreign currencies.

- Limited Travel Insurance: While some travel benefits are included, comprehensive travel insurance is not part of the package.

Weighing these factors will help you determine if the Tangerine World Mastercard aligns with your financial goals and lifestyle.

[related]What Are the Fees on the Tangerine World Mastercard?

Being aware of the associated fees is crucial for effective financial planning. Here’s a breakdown of the key fees:

- Annual Fee: None.

- Purchase Interest Rate: 20.95%.

- Cash Advance Interest Rate: 22.95%.

- Balance Transfer Interest Rate: 22.95%.

- Foreign Currency Conversion Fee: 2.5% of the transaction amount.

- Over-Limit Fee: $25.

- Dishonoured Payment Fee: $25.

Understanding these fees will help you manage your card usage effectively and avoid unexpected charges.

Contacting Tangerine for Assistance

If you have questions or need assistance regarding your Tangerine World Mastercard, Tangerine offers several customer support options:

- Phone Support: Call 1-888-826-4374 for 24/7 assistance.

- Online Chat: Access live chat support through the Tangerine website.

- Email Support: Send inquiries via the secure messaging system in your online banking account.

- Mobile App: Use the Tangerine Mobile Banking app to manage your account and seek support.

These channels ensure you have access to help whenever you need it, providing peace of mind in managing your credit card.

Is It Worth It?

The Tangerine World Mastercard offers a compelling mix of customizable cash-back rewards, travel perks, and insurance benefits, all without an annual fee. If you meet the income requirements and are looking for a flexible rewards program tailored to your spending habits, this card is a strong contender.

However, consider the foreign transaction fees and assess whether the travel benefits align with your needs. By evaluating these factors, you can determine if the Tangerine World Mastercard is the right fit for your financial strategy.

Ready to take the next step? Apply today and start enjoying the benefits that come with the Tangerine World Mastercard.