Discover It Secured Card Apply: Requirements, Fees, APR

Learn how to apply for the Discover it Secured Credit Card, its benefits, and determine if it’s the right choice for building your credit.

Anúncios

Building or rebuilding your credit can be a challenging journey, but the right credit card can make all the difference. The Discover it Secured Credit Card is designed to help individuals establish or improve their credit history while enjoying cash-back rewards.

If you’re considering this card, understanding the application process, benefits, and associated fees is essential. Let’s explore the details to help you make an informed decision.

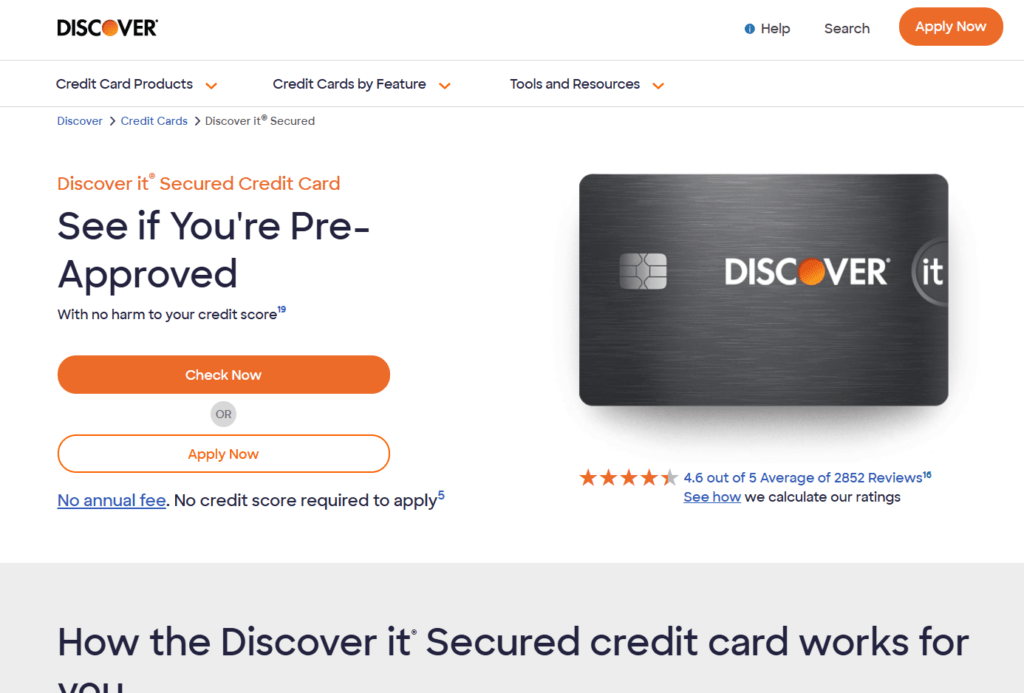

How to Apply for the Discover it Secured Credit Card

Applying for the Discover it Secured Credit Card is a straightforward process that can be completed online, ensuring convenience and efficiency. Here’s a step-by-step guide to assist you:

- Visit the Official Discover Website: Navigate to the Discover it Secured Credit Card page.

- Initiate the Application: Click on the “Apply Now” button to begin the application process.

- Provide Personal Information: Enter your full name, date of birth, Social Security number, and contact details.

- Submit Financial Details: Include information about your employment status, annual income, and housing expenses.

- Agree to Terms and Conditions: Review and consent to the terms, which include a credit assessment.

- Provide Security Deposit: Be prepared to provide a refundable security deposit, starting at $200, which will determine your credit line.

- Review and Submit: Double-check all entered information for accuracy and submit your application.

After submission, Discover will review your application and notify you of the outcome, typically within a few business days. If approved, your new card will be mailed to you promptly.

Why Choose the Discover it Secured Credit Card

The Discover it Secured Credit Card offers a range of benefits tailored to individuals looking to build or rebuild their credit. Here’s an overview of what makes this card appealing:

- No Annual Fee: Enjoy the benefits of the card without the burden of an annual fee.

- Cash-Back Rewards: Earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter. Plus, earn unlimited 1% cash back on all other purchases.

- Cashback Match: Discover will automatically match all the cash back you’ve earned at the end of your first year, effectively doubling your rewards.

- Free FICO Credit Score: Monitor your credit progress with free access to your FICO Credit Score.

- Transition to Unsecured Card: After seven months, Discover begins automatic monthly reviews to see if you qualify to upgrade to an unsecured card and get your deposit back.

These features collectively provide a robust package for cardholders seeking to build credit responsibly while enjoying rewards.

Requirements to Apply for the Discover it Secured Credit Card

Before applying, it’s essential to ensure you meet the eligibility criteria for the Discover it Secured Credit Card. The primary requirements include:

- Age: Must be at least 18 years old.

- Social Security Number: A valid Social Security number is required.

- U.S. Residency: Must have a U.S. address.

- Bank Account: A U.S. bank account is necessary to provide the security deposit.

- Security Deposit: Be prepared to provide a refundable security deposit, starting at $200, which will determine your credit line.

Meeting these criteria increases the likelihood of a successful application and access to the card’s benefits.

Discounts and Rewards Program

The Discover it Secured Credit Card offers a flexible rewards program designed to maximize your cash-back earnings based on your spending habits. Key aspects of the program include:

- 2% Cash Back: Earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter.

- 1% Cash Back: Earn unlimited 1% cash back on all other purchases.

- Cashback Match: At the end of your first year, Discover will automatically match all the cash back you’ve earned, effectively doubling your rewards.

This structure allows you to tailor your rewards to align with your spending patterns, maximizing the value you receive from everyday purchases.

Advantages and Disadvantages

Understanding the pros and cons of the Discover it Secured Credit Card will help you assess its suitability for your financial needs.

Advantages:

- No Annual Fee: Enjoy the benefits of the card without the burden of an annual fee.

- Cash-Back Rewards: Earn rewards on everyday purchases, including bonus categories.

- Credit Building: Responsible use can help build or rebuild your credit history.

- Transition Opportunity: Potential to upgrade to an unsecured card and receive your deposit back after seven months.

Disadvantages:

- Security Deposit Required: An upfront refundable security deposit is necessary to open the account.

- Limited Bonus Categories: Higher cash-back rates are limited to gas stations and restaurants, with a quarterly cap.

Weighing these factors will help you determine if the Discover it Secured Credit Card aligns with your financial goals and lifestyle.

What Are the Fees on the Discover it Secured Credit Card?

Being aware of the associated fees is crucial for effective financial planning. Here’s a breakdown of the key fees:

- Annual Fee: None.

- Purchase APR: Variable rate, currently 27.49%.

- Balance Transfer Fee: 5% of the amount of each transfer.

- Cash Advance Fee: Either $10 or 5% of the amount of each cash advance, whichever is greater.

- Late Payment Fee: Up to $41.

- Returned Payment Fee: Up to $41.

Understanding these fees ensures you can manage your account responsibly and avoid unnecessary charges.

Contacting Discover for Assistance

If you have questions about your application or need assistance managing your account, Discover offers several ways to get in touch:

- Phone Support: Call 1-800-DISCOVER (1-800-347-2683) for 24/7 customer service.

- Online Account Center: Log in to your account at Discover’s website to manage your card and access support.

- Mobile App: Download the Discover Mobile App to manage your account on the go and contact customer service.

Discover ensures that help is always available whenever you need it.

Is It Worth It?

The Discover it Secured Credit Card is a strong option for those building or rebuilding credit. It has no required credit score and allows you to earn rewards on all your purchases, including bonus rewards on dining and gas station purchases.

However, its earning rates are lower than many nonsecured cash-back cards, so you’ll want to explore other options if you don’t need a secured card.

If your goal is to establish or improve your credit while earning rewards, this card offers a valuable opportunity. Apply today and take the first step toward a stronger financial future.